Generali ha completato con successo il collocamento del suo ottavo green bond e annuncia i risultati finali del suo riacquisto di tre serie di obbligazioni subordinate

14 gennaio 2025 - 17:15 price sensitive

IL PRESENTE COMUNICATO NON È DESTINATO ALLA DIFFUSIONE, PUBBLICAZIONE O DISTRIBUZIONE, DIRETTA O INDIRETTA, AD ALCUNA PERSONA CHE SI TROVI O SIA RESIDENTE NEGLI STATI UNITI D’AMERICA, NEI SUOI TERRITORI O POSSEDIMENTI, IN QUALUNQUE STATO DEGLI STATI UNITI D’AMERICA E NEL DISTRICT OF COLUMBIA O A QUALSIASI U.S. PERSON (COME DEFINITA NEL REGULATION S OF THE UNITED STATES SECURITIES ACT DEL 1933, COME MODIFICATO) OVVERO A QUALSIASI PERSONA CHE SI TROVI O SIA RESIDENTE IN OGNI ALTRA GIURISDIZIONE IN CUI DIFFONDERE, PUBBLICARE O DISTRIBUIRE QUESTO ANNUNCIO È CONTRARIO ALLE LEGGI E AI REGOLAMENTI APPLICABILI

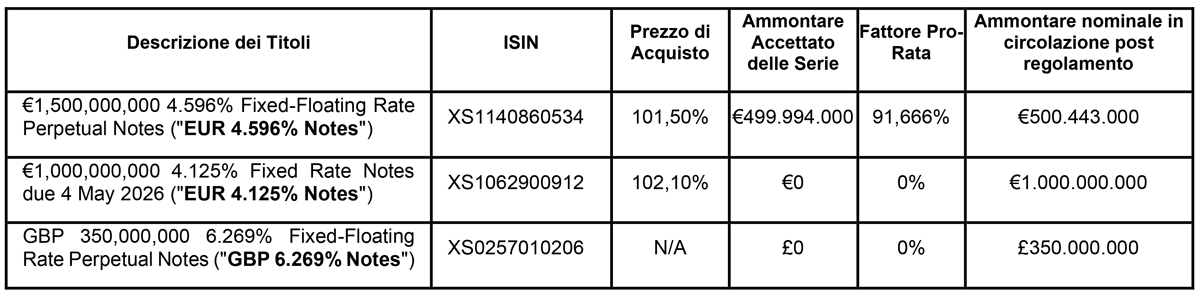

Trieste – Assicurazioni Generali S.p.A. (“Generali” o l’“Offerente”) annuncia i risultati finali del riacquisto per cassa (l’“Offerta”) dei titoli (i) “€ 1,500,000,000 4.596 per cent. Fixed-Floating Rate Perpetual Notes” (XS1140860534); (ii) “€ 1,000,000,000 4.125 per cent. Fixed Rate Notes” (XS1062900912); e (iii) “GBP 350,000,000 6.269 per cent. Fixed-Floating Rate Perpetual Notes” (XS0257010206) (congiuntamente, i "Titoli" e ciascuno, una “Serie”).

Alla Scadenza dell’Offerta, l’importo nominale complessivo di Titoli offerti per il riacquisto ammontava ad €1.190.585.554 (equivalente), che rappresenta approssimativamente il 49% dell’importo nominale complessivo dei Titoli in circolazione. In conformità con i termini e le condizioni dell’Offerta, Generali accetterà in riacquisto un importo nominale aggregato di € 499.994.000 dei Titoli EUR 4,596%.

Generali ha inoltre concluso l’emissione di un nuovo titolo in euro con scadenza luglio 2035, emesso sotto forma di green bond ai sensi del Sustainability Bond Framework dell'Offerente disponibile al seguente indirizzo www.generali.com (i “Nuovi Titoli”). La nuova emissione green conferma la posizione primaria di Generali in materia di Sostenibilità.

I Nuovi Titoli hanno ricevuto dagli investitori domanda per oltre € 2,1 miliardi durante la fase del bookbuilding, oltre 4 volte l’offerta, da una base altamente diversificata di oltre 180 investitori istituzionali, compresa una presenza significativa di fondi con mandati Green/SRI.

I termini dell’emissione dei Nuovi Titoli e i loro pricing sono i seguenti:

Emittente: Assicurazioni Generali S.p.A.

Rating per l’emissione: Baa2 / BBB+ (Moody’s / Fitch)

Importo: € 500.000.000

Data di lancio: 7 gennaio 2025

Data di regolamento: 14 gennaio 2025

Scadenza: 16 luglio 2035

Cedola: 4,083% p.a. pagabile annualmente in via posticipata

Data di stacco della prima cedola: 16 luglio 2025

Prezzo di emissione: 100%

ISIN: XS2971648725

Quotazione: Borsa di Lussemburgo, ExtraMOT

Spread: MS + 160bps

Euro Mid-Swap (interpolazione 10,5anni): 2,485%

Il Group CFO di Generali, Cristiano Borean, ha affermato: “La transazione è coerente con il nostro approccio proattivo alla gestione del profilo di scadenza del debito. Riduce il rischio di rifinanziamento e prolunga la durata media del nostro debito, di cui circa il 50% è emesso in formato ESG. Inoltre, porterà anche ad un costo medio del debito inferiore”.

RIEPILOGO DEI RISULTATI FINALI DEL RIACQUISTO

Alla Scadenza dell’Offerta, l’importo nominale complessivo dei Titoli di tutte le Serie validamente offerti in riacquisto ai sensi dell’Offerta era pari a € 1.190.585.554 equivalente. L’Offerente ha deciso che l’Ammontare Accettato (Acceptance Amount) sarà pari a €499.994.000. Il rispettivo Ammontare Accettato delle Serie (Series Acceptance Amount) e il Fattore Pro-Rata (Pro-Ration Factor) rilevante sono indicati nella tabella sottostante.

L’acquisto, da parte dell’Offerente di qualsiasi Titolo validamente offerto per il riacquisto ai sensi dell’Offerta è condizionato al buon esito (ad insindacabile giudizio dell’Offerente) dell’Offerta di Nuovi Titoli (New Notes Offering) nei termini ritenuti soddisfacenti dall’Offerente (a suo giudizio) (la “Condizione di Nuova Emissione” (New Issue Condition)).

La Data di Regolamento dell’Offerta è prevista per il 15 gennaio 2025. Alla Data di Regolamento, condizionato al soddisfacimento (ovvero alla rinuncia) della Condizione di Nuova Emissione (alla o prima della Data di Regolamento), l’Offerente pagherà (o procurerà il pagamento del) il Corrispettivo del Prezzo d’Acquisto e l’Importo degli Interessi Maturati a quei Portatori le cui adesioni all’Offerta sono state accolte in relazione ai Titoli accettati in riacquisto dall’Offerente.

L’Offerta è stata effettuata secondo i termini e le condizioni previste nel memorandum datato 7 gennaio 2025 (il “Tender Offer Memorandum”). I termini con lettera maiuscola utilizzati nel presente comunicato ma non definiti hanno lo stesso significato attribuitogli nel Tender Offer Memorandum.

HSBC Continental Europe (lo “Structurer”) e Barclays Bank Ireland PLC, Crédit Agricole Corporate and Investment Bank, ING Bank N.V., Mediobanca – Banca di Credito Finanziario S.p.A., Morgan Stanley & Co. International plc and UniCredit Bank GmbH (congiuntamente allo Structurer, i Dealer Managers, e ciascuno un Dealer Manager) agiscono come Dealer Managers dell’Offerta.

Kroll Issuer Services Limited agisce come Tender Agent in relazione all’Offerta.

TENDER AGENT

Kroll Issuer Services Limited

The Shard

32 London Bridge Street

Londra SE1 9SG

Regno Unito

Tel: +44 20 7704 0880

Attention: Arlind Bytyqi

Email: generali@is.kroll.com

Offer Website: https://deals.is.kroll.com/generali

STRUCTURING ADVISER AND DEALER MANAGER

HSBC Continental Europe

38, avenue Kléber

75116 Parigi

Francia

Telefono: +44 20 7992 6237

Attention: Liability Management, DCM

Email: LM_EMEA@hsbc.com

Morgan Stanley & Co. International plc

25 Cabot Square

Canary Wharf

London E14 4QA

United Kingdom

Attention: Liability Management Team, Global Capital Markets

Email: liabilitymanagementeurope@morganstanley.com

Telephone: +44 20 7677 5040

UniCredit Bank GmbH

Arabellastrasse 12

81925 Munich

Germany

Attention: DCM Italy; Liability Management

Email: liability.management@unicredit.de

Telephone: +49 89 378 15582

DEALER MANAGERS

Barclays Bank Ireland PLC

One Molesworth Street

Dublin 2

D02 RF29

Ireland

Attention: Liability Management Group

Email: eu.lm@barclays.com

Telephone: +44 20 3134 8515

Crédit Agricole Corporate and Investment Bank

12 Place des Etats-Unis

CS 70052

92547 Montrouge Cedex

France

Attention: Liability Management

Email: Liability.Management@ca-cib.com

Telephone: +44 207 214 5733

ING Bank N.V.

Foppingadreef 7

1102 BD Amsterdam

The Netherlands

Attention: Liability Management Team

Email: liability.management@ing.com

Telephone: +44 2077676784

Mediobanca – Banca di Credito Finanziario S.p.A.

Piazzetta Enrico Cuccia, 1

20121 Milan

Italy

Attention: Liability Management FIG

Email: MB_Liability_Management_FIG@mediobanca.com

Telephone: +39 02 8829 240

DISCLAIMER

Il presente comunicato deve essere letto congiuntamente al Tender Offer Memorandum. Il presente comunicato e il Tender Offer Memorandum contengono importanti informazioni che dovrebbero essere lette attentamente prima dell’assunzione di qualsiasi decisione in merito all’Offerta. L'investitore che abbia qualsiasi dubbio in merito al contenuto del presente comunicato o del Tender Offer Memorandum o in relazione alle decisioni da assumere, è invitato a ottenere proprie consulenze finanziarie o legali, anche in merito a qualsiasi conseguenza fiscale, immediatamente presso il proprio stock broker, bank manager, legale, contabile o altri consulenti finanziari o legali indipendenti. Ciascuna persona fisica o giuridica i cui i Titoli siano depositati presso un intermediario finanziario, una banca, un custode, un trust o un qualsiasi altro soggetto terzo o intermediario deve contattare tale soggetto se intende offrire i Titoli in vendita ai sensi dell’Offerta. Né i Dealer Manager, né il Tender Agent, né l’Offerente hanno espresso alcuna raccomandazione in merito all'offerta in vendita dei Titoli da parte dei Portatori ai sensi dell’Offerta.

Qualsiasi decisione di investimento relativa all’acquisto dei Nuovi Titoli dovrebbe essere effettuata esclusivamente sulla base delle informazioni contenute nel prospetto di base relativo al €15.000.000.000 Euro Medium Term Note Programme dell’Offerente datato 25 maggio 2022 (il Prospetto di Base) come di volta in volta supplementato e nelle condizioni definitive che saranno predisposte in relazione all’emissione e quotazione dei Nuovi Titoli (le Condizioni Definitive), che includeranno le condizioni definitive dei Nuovi Titoli. Nel rispetto della normativa applicabile, il Prospetto di Base, i relativi supplementi e le Condizioni Definitive saranno disponibili su richiesta dai joint lead managers dell’emissione dei Nuovi Titoli. Copie del Prospetto di Base sono disponibili, e copie delle Condizioni Definitive saranno disponibili (al momento dell'emissione) sul sito internet della Borsa di Lussemburgo (www.luxse.com) e sul sito internet di Assicurazioni Generali.

OFFER AND DISTRIBUTION RESTRICTIONS

Neither this announcement nor the Tender Offer Memorandum constitute an invitation to participate in the Offer in any jurisdiction in which, or to any person to or from whom, it is unlawful to make such invitation or for there to be such participation under applicable securities laws or otherwise. The distribution of this announcement and the Tender Offer Memorandum in certain jurisdictions (in particular, the United States, Italy, the United Kingdom, France and Belgium) may be restricted by law. Persons into whose possession this announcement or the Tender Offer Memorandum comes are required by each of Dealer Managers, the Offeror and the Tender Agent to inform themselves about, and to observe, any such restrictions.

No action has been or will be taken in any jurisdiction in relation to the New Notes that would permit a public offering of securities.

United States

The Offer is not being made, and will not be made, directly or indirectly in or into, or by use of the mail of, or by any means or instrumentality of interstate or foreign commerce of, or of any facilities of a national securities exchange of, the United States or to any U.S. Person (as defined in Regulation S of the United States Securities Act of 1933, as amended (each a U.S. Person)). This includes, but is not limited to, facsimile transmission, electronic mail, telex, telephone, the internet and other forms of electronic communication. The Notes may not be tendered in the Offer by any such use, means, instrumentality or facility from or within the United States or by persons located or resident in the United States, as defined in Regulation S of the United States Securities Act of 1933, as amended. Accordingly, copies of this announcement, the Tender Offer Memorandum and any other documents or materials relating to the Offer are not being, and must not be, directly or indirectly mailed or otherwise transmitted, distributed or forwarded (including, without limitation, by custodians, nominees or trustees) in or into the United States or to any persons located or resident in the United States. Any purported tender of Notes resulting directly or indirectly from a violation of these restrictions will be invalid, and any purported tender of Notes made by a person located or resident in the United States, a U.S. Person, by any person acting for the account or benefit of a U.S. Person, or from within the United States or from any agent, fiduciary or other intermediary acting on a non-discretionary basis for a principal giving instructions from within the United States will be invalid and will not be accepted.

Neither this announcement nor the Tender Offer Memorandum constitute an offer of securities for sale in the United States or to U.S. Persons. Securities may not be offered or sold in the United States absent registration under, or an exemption from the registration requirements of, the Securities Act. The New Notes have not been, and will not be, registered under the Securities Act or the securities laws of any state or other jurisdiction of the United States, and may not be offered, sold or delivered, directly or indirectly, in the United States or to, or for the account or benefit of, U.S. Persons.

Each Holder participating in the Offer will represent that it is not located in the United States and is not participating in the Offer from the United States, or that it is acting on a non-discretionary basis for a principal located outside the United States that is not giving an order to participate in the Offer from the United States and who is not a U.S. Person. For the purposes of this and the above paragraphs, United States means United States of America, its territories and possessions (including Puerto Rico, the U.S. Virgin Islands, Guam, America Samoa, Wake Island and the Northern Mariana Islands), any state of the United States of America and the District of Columbia.

Italy

Neither this announcement, the Tender Offer Memorandum nor any other documents or material relating to the Offer have been or will be submitted to the clearance procedure of the Commissione Nazionale per le Società e la Borsa (CONSOB), pursuant to applicable Italian laws and regulations.

In Italy, the Offer on the Notes is being carried out as an exempted offer pursuant to article 101-bis, paragraph 3-bis, of Legislative Decree No. 58 of 24 February 1998, as amended (the Financial Services Act) and article 35-bis, paragraph 4 of CONSOB Regulation No. 11971 of 14 May 1999, as amended.

Holders or beneficial owners of the Notes can tender their Notes for purchase through authorised persons (such as investment firms, banks or financial intermediaries permitted to conduct such activities in the Republic of Italy in accordance with the Financial Services Act, CONSOB Regulation No. 20307 of 15 February 2018, as amended from time to time, and Legislative Decree No. 385 of 1 September 1993, as amended) and in compliance with applicable laws and regulations or with requirements imposed by CONSOB or any other Italian authority.

Each intermediary must comply with the applicable laws and regulations concerning information duties vis-à-vis its clients in connection with the Notes or this announcement or the Tender Offer Memorandum.

United Kingdom

The communication of this announcement, the Tender Offer Memorandum and any other documents or materials relating to the Offer is not being made and such documents and/or materials have not been approved by an authorised person for the purposes of section 21 of the Financial Services and Markets Act 2000. Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials as a financial promotion is only being made to those persons in the United Kingdom falling within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the Financial Promotion Order) or persons who are within Article 43 of the Financial Promotion Order or any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order.

France

The Offer is not being made, directly or indirectly, in the Republic of France (France) other than to qualified investors (investisseurs qualifiés) as referred to in Article L.411-2 1° of the French Code monétaire et financier and defined in Article 2(e) of Regulation (EU) 2017/1129 (as amended). Neither this announcement nor the Tender Offer Memorandum nor any other documents or materials relating to the Offer have been or shall be distributed in France other than to qualified investors (investisseurs qualifiés) and only qualified investors (investisseurs qualifiés) are eligible to participate in the Offer. This announcement, the Tender Offer Memorandum and any other document or material relating to the Offer have not been and will not be submitted for clearance to nor approved by the Autorité des marchés financiers.

Belgium

Neither this announcement, the Tender Offer Memorandum nor any other documents or materials relating to the Offer have been submitted to or will be submitted for approval or recognition to the Belgian Financial Services and Markets Authority (Autorité des services et marches financiers / Autoriteit financiële diensten en markten) and, accordingly, the Offer may not be made in Belgium by way of a public offering, as defined in Articles 3 and 6 of the Belgian Law of 1 April 2007 on public takeover bids (the "Belgian Takeover Law") or as defined in Article 3 of the Belgian Law of 16 June 2006 on the public offer of placement instruments and the admission to trading of placement instruments on regulated markets (the "Belgian Prospectus Law"), both as amended or replaced from time to time. Accordingly, the Offer may not be advertised and the Offer will not be extended, and neither this announcement, the Tender Offer Memorandum nor any other documents or materials relating to the Offer (including any memorandum, information circular, brochure or any similar documents) has been or shall be distributed or made available, directly or indirectly, to any person in Belgium other than (i) to "qualified investors" in the sense of Article 10 of the Belgian Prospectus Law, acting on their own account; or (ii) in any other circumstances set out in Article 6, §4 of the Belgian Takeover Law and Article 3, §2-4 of the Belgian Prospectus Law. This Tender Offer Memorandum has been issued only for the personal use of the above qualified investors and exclusively for the purpose of the Offer. Accordingly, the information contained in this Tender Offer Memorandum may not be used for any other purpose or disclosed to any other person in Belgium.

General

This announcement and the Tender Offer Memorandum do not constitute an offer to sell or buy or the solicitation of an offer to sell or buy the Notes, and tenders of Notes pursuant to the Offer will not be accepted from Holders in any circumstances in which such offer or solicitation is unlawful. In those jurisdictions where the securities, blue sky or other laws require the Offer to be made by a licensed broker or dealer and any of the Dealer Managers or any of their respective affiliates is such a licensed broker or dealer in any such jurisdiction, the Offer shall be deemed to be made on behalf of the Offeror by such Dealer Manager or affiliate (as the case may be) in such jurisdiction.