Generali Group Consolidated Results as at 30 June 2024

09 August 2024 - 07:00 price sensitive

Generali achieves continued growth in operating result thanks to an increasingly diversified business profile. Solid capital position confirmed

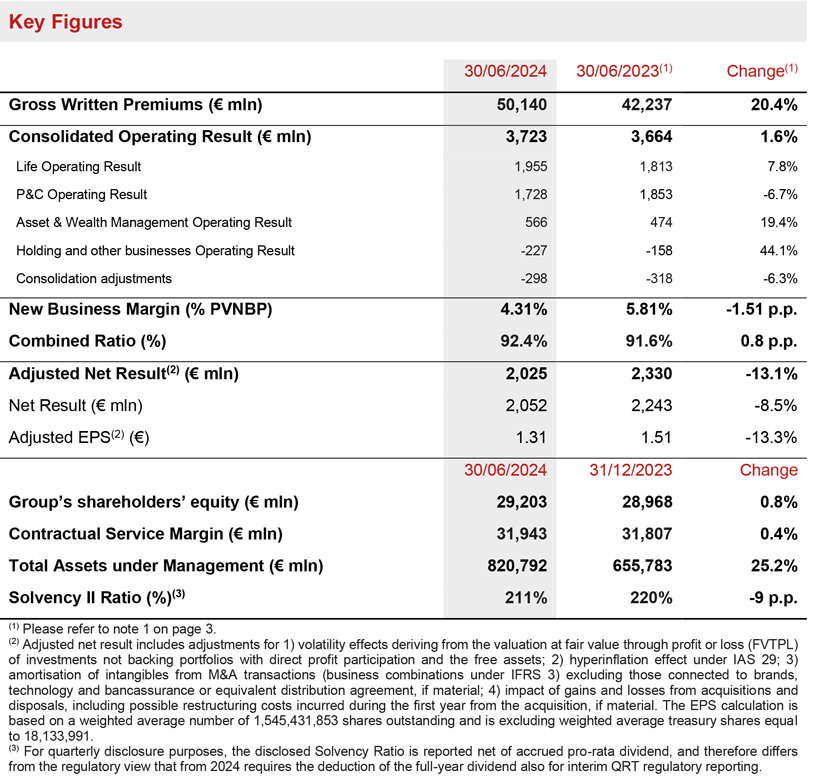

- Gross written premiums increased significantly to € 50.1 billion (+20.4%), driven by substantial growth in Life (+26.6%) and P&C (+10.5%) segments

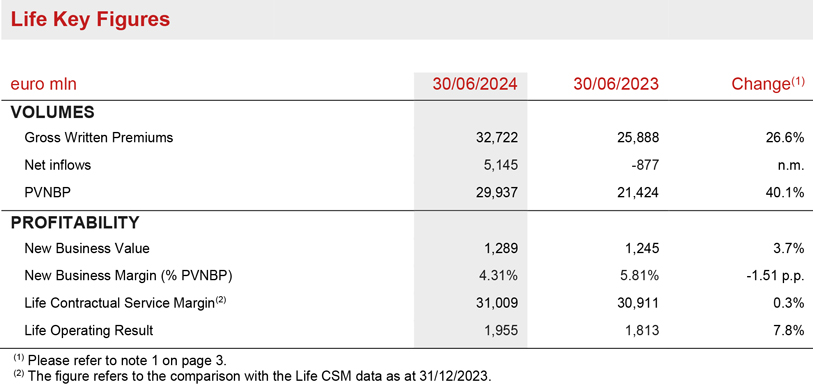

- Life net inflows were very positive at € 5.1 billion entirely driven by protection and unit-linked. New Business Value grew to € 1,289 million (+3.7%)

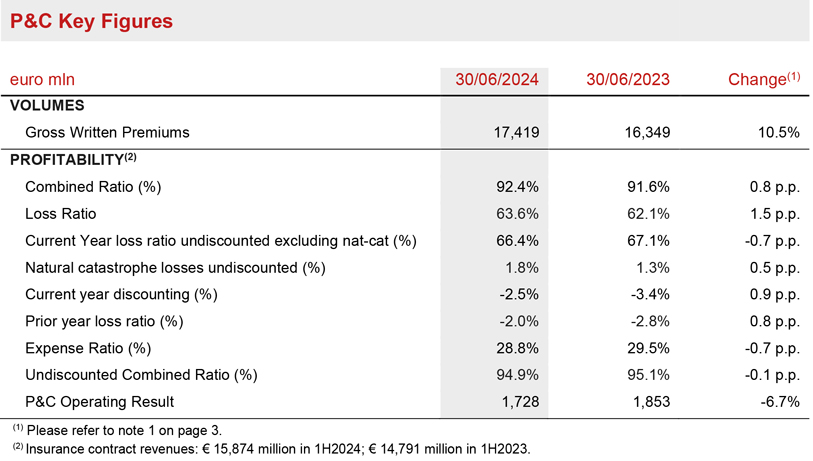

- Combined Ratio was 92.4% (+0.8 p.p.); undiscounted Combined Ratio improved to 94.9% (-0.1 p.p.)

- Continued growth in operating result to € 3.7 billion (+1.6%), led by the strong contribution of the Life and Asset & Wealth Management segments

- Adjusted net result was € 2.0 billion (-13.1%) mainly as a result of capital gains and other one-offs recorded during 1H2023. Excluding these effects, the adjusted net result would have been stable

- The Group’s Total Assets Under Management reached € 821 billion (+25.2%) mainly driven by the consolidation of Conning Holdings Limited

- Solid capital position, with Solvency Ratio at 211% (220% FY2023), primarily reflecting the acquisition of Liberty Seguros and the launch of the € 500 million buy-back programme already announced

Generali Group CEO, Philippe Donnet, said: “With continued operating result growth and the return to strong positive Life net inflows, our results confirm the resilience of Generali, the effectiveness of our strategy and our ability to deliver value for all stakeholders also in a complex macroeconomic and geopolitical context. We are evolving as a global insurance and asset management player with an increasingly diversified business profile. Our relentless focus on cash and capital position allows us to launch the € 500 million share buy-back, highlighting our commitment to increased shareholder remuneration. With only a few months until the close of our ‘Lifetime Partner 24: Driving Growth’ plan, we are fully on track to reach all its ambitious targets thanks to the continued efforts of all our colleagues and agents. Looking ahead, I am working with the top management team on the new Group strategy that we will present at our Investor Day on 30 January 2025 in Venice.”

Executive Summary

Milan - At a meeting chaired by Andrea Sironi, the Generali Board of Directors approved the 2024 Consolidated Half-Year Financial Report of the Generali Group1.

Gross written premiums rose to € 50.1 billion (+20.4%), thanks to significant growth in both the Life and P&C segments.

Life net inflows were very positive, exceeding € 5.1 billion entirely driven by protection and unit-linked, in line with the Group’s strategy and reflecting the success of commercial actions implemented since 2023.

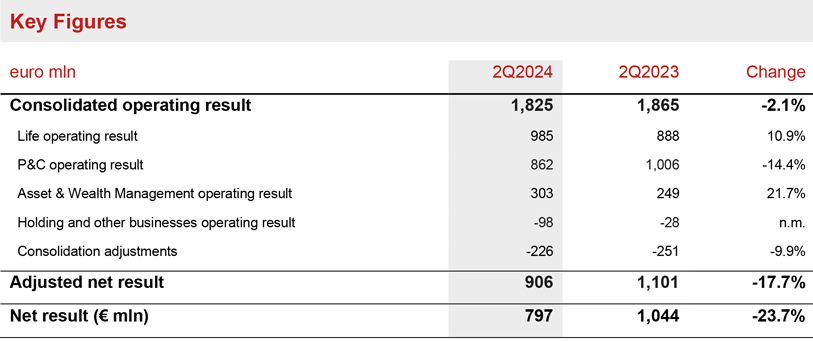

The operating result grew to € 3,723 million (+1.6%), thanks to the positive performance of the Life and the Asset & Wealth Management segments as evidence of the value of the diversified profit sources.

In particular, the operating result of the Life segment increased to € 1,955 million (+7.8%) and the New Business Value improved to € 1,289 million (+3.7%).

The operating result of the P&C segment stood at € 1,728 million (-6.7%) with the Combined Ratio at 92.4% (+0.8 p.p.) reflecting a higher impact of natural catastrophes and a lower benefit from discounting.

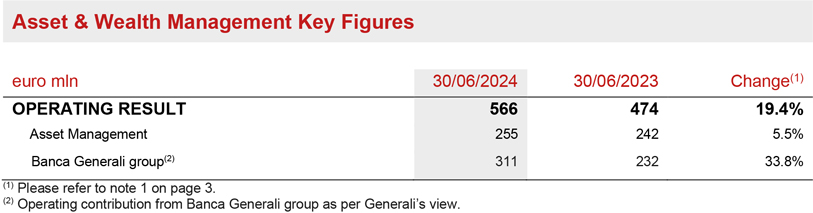

The operating result of the Asset & Wealth Management segment grew to € 566 million (+19.4%) thanks to the continued strong performance of Banca Generali and the positive result of Asset Management benefitting from the contribution of Conning Holdings Limited (CHL).

The operating result of the Holding and other businesses segment stood at € -227 million (€ -158 million 1H2023).

The adjusted net result2 was at € 2,025 million (€ 2,330 million 1H2023) mainly as a result of capital gains and other one-offs recorded during 1H2023. Excluding these effects, the adjusted net result would have been broadly stable. The net result amounted to € 2,052 million (€ 2,243 million 1H2023).

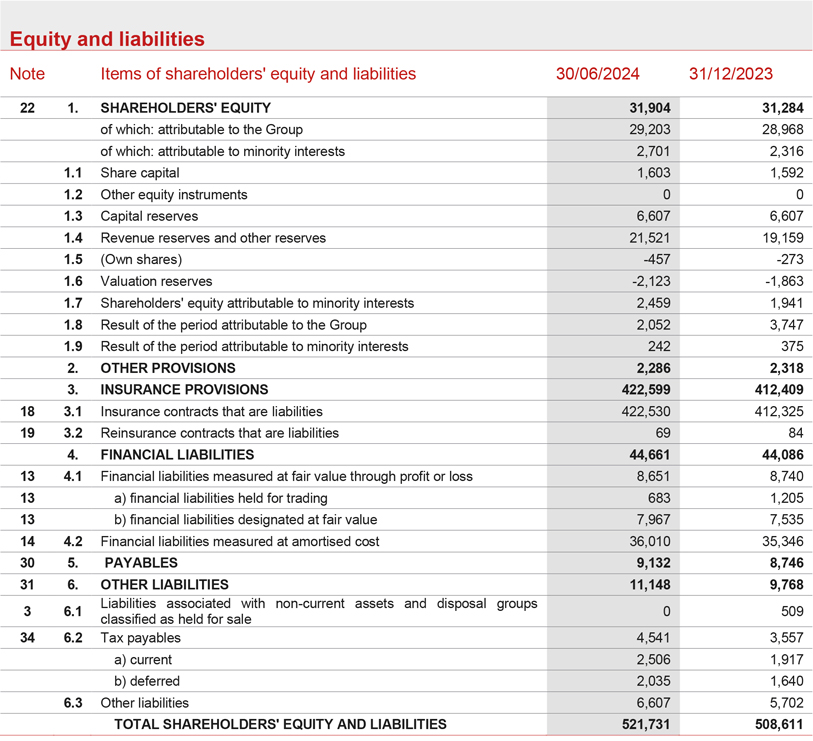

The Group’s shareholders' equity increased to € 29.2 billion (+0.8%), thanks to the net result for the period, partially offset by the 2023 dividend payment.

The Contractual Service Margin (CSM) rose to € 31.9 billion (€ 31.8 billion FY2023).

The Group’s Total Assets Under Management (AUM) grew significantly to € 821 billion (+25.2% compared to FY2023) mainly reflecting the inclusion of the AUM of CHL.

The Group confirms its solid capital position, with the Solvency Ratio at 211% (220% FY2023) driven primarily by the acquisition of Liberty Seguros and the launch of the € 500 million buy-back programme already announced.

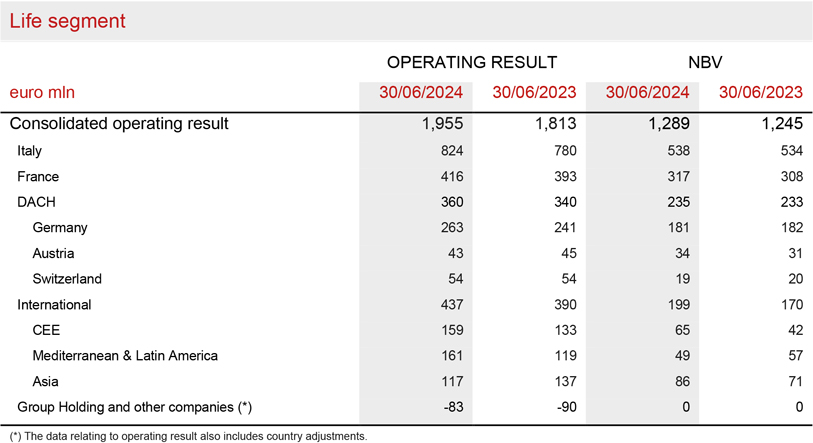

Life Segment

- Operating result rose to € 1,955 million (+7.8%)

- New Business Margin was 4.31% (-1.51 p.p.)

- New Business Value (NBV) grew to € 1,289 million (+3.7%)

Gross written premiums in the Life segment3 grew significantly to € 32,722 million (+26.6%) driven by the strong performance across all business lines. The protection line confirmed its healthy growth trajectory (+11.9%) in all the main countries. The savings line substantially improved (+41.6%), mostly thanks to France, Italy and Asia. The unit-linked line was notably up (+17.8%), led by Italy and France.

Life Net inflows continued the positive growth momentum exceeding € 5.1 billion. The protection and unit-linked lines recorded positive net inflows, with protection inflows growing to € 3,068 million, led by Italy, France and Germany, while net inflows in the unit-linked line were € 2,573 million, mainly driven by France, Germany and Italy. Net outflows from savings and pension (€ -496 million) improved very significantly (€ -6,228 million 1H2023) also benefitting from the commercial actions implemented since 2023.

New business volumes (expressed in terms of present value of new business premiums - PVNBP) increased significantly to € 29.9 billion (+40.1%), thanks to:

- strong production of savings in Italy reflecting the commercial strategy;

- France, benefitting from the market momentum in hybrid products;

- China, which recorded exceptional volumes in the first quarter;

- growth of protection business, amplified by the IFRS 17 accounting treatment of collective protection business in France4. After neutralising for this accounting effect with no real economic implications, PVNBP would have grown by 29.1%.

New Business Value (NBV) rose to € 1,289 million (+3.7%) supported by strong volumes. The New Business Margin on PVNBP (NBM) stood at 4.31% (-1.51 p.p.) also reflecting the accounting effect of French protection business (-0.5 p.p.), commercial initiatives to support net inflows in Italy and France (-0.7 p.p.), and the effect of lower interest rates (-0.3 p.p.). Neutralising for this accounting effect, the decline in NBM would be around 1 p.p..

The Life Contractual Service Margin (Life CSM) increased to € 31.0 billion (€ 30.9 billion FY2023). The positive development was mainly driven by the contribution of the Life New Business CSM of € 1,513 million, which, coupled with the expected return of € 848 million, more than offset the Life CSM release of € 1,489 million. The latter also represented the main driver (around 76%) of the operating result, which increased to € 1,955 million (€ 1,813 million 1H2023).

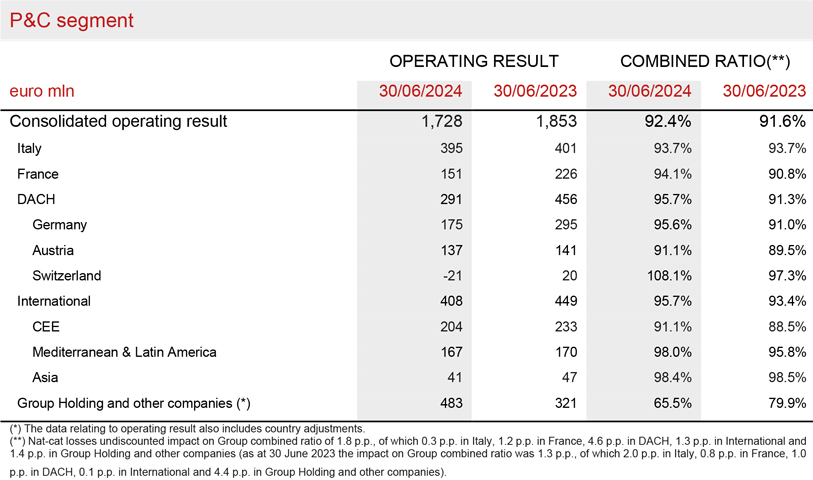

P&C Segment

- Premiums increased to € 17,419 million (+10.5%)

- Combined Ratio was 92.4% (+0.8 p.p.). Undiscounted Combined Ratio improved to 94.9% (-0.1 p.p.)

- Operating result was at € 1,728 million (-6.7%)

P&C gross written premiums grew to € 17.4 billion (+10.5%) thanks to the performance of both business lines. Non-motor improved strongly (+6.0%), achieving widespread growth across all main areas in which the Group operates. The motor line rose by 18.0%, across all the main areas and specifically thanks to the positive performance seen in CEE, Germany, Austria and Argentina. Excluding the contribution from Argentina, a country impacted by hyperinflation, motor line premiums increased by 5.5%.

The Combined Ratio stood at 92.4% (91.6% 1H2023) due to an increase in the loss ratio to 63.6% (+1.5 p.p.), which was caused by a lower current year discounting benefit (+0.9 p.p.), lower prior year development (+0.8 p.p.) and a greater impact of natural catastrophes with undiscounted losses increasing to 1.8% (1.3% 1H2023). The undiscounted combined ratio improved to 94.9% (95.1% 1H2023). The undiscounted current year loss ratio (excluding nat-cat) improved to 66.4% (67.1% 1H2023). The expense ratio decreased to 28.8% (29.5% 1H2023).

The operating result amounted to € 1,728 million (€ 1,853 million 1H2023). The operating insurance service result was € 1,204 million (€ 1,239 million 1H2023) reflecting the trend in the Combined Ratio.

The operating investment result was € 525 million (€ 615 million 1H2023) impacted by higher insurance finance expenses, which were only partially compensated by higher operating investment income, also supported by acquisitions.

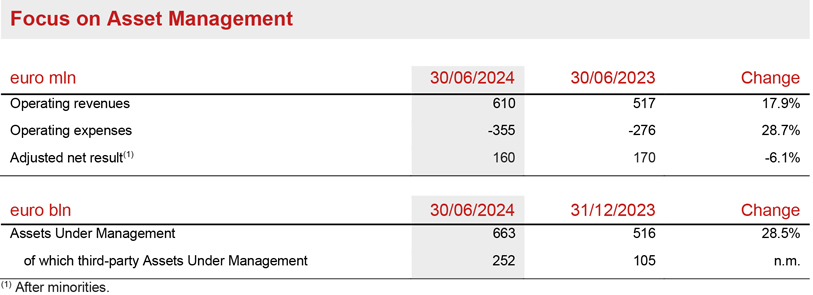

Asset & Wealth Management Segment

- Asset & Wealth Management operating result grew to € 566 million (+19.4%)

- Banca Generali group operating result increased strongly to € 311 million (+33.8%)

The operating result of the Asset & Wealth Management segment grew significantly to € 566 million (+19.4%).

The Asset Management operating result increased to € 255 million (+5.5%) reflecting the consolidation of CHL.

The operating result of the Banca Generali group rose substantially to € 311 million (+33.8%), thanks to the improvement in the net interest margin coupled with the continued diversification of fee income sources and a significant contribution of performance fees. Total net inflows at Banca Generali in 1H2024 were € 3.6 billion.

The adjusted net result of the Asset Management segment was € 160 million (-6.1%). This was influenced by some one-off costs related to the acquisition of CHL as well as the dilution effect from the 16.75% stake of Generali Investments Holding held by Cathay Life.

The AUM pertaining to the Asset Management companies were € 663 billion, up 28.5% compared to FY2023 also thanks to the acquisition of CHL. Third-party AUM stood at € 252 billion compared to FY2023, including € 149 billion relating to CHL. Net flows from external clients amount to € -3.8 billion, concentrated in a few large low-margin mandates.

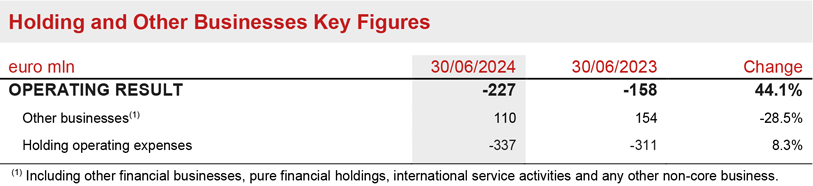

Holding and Other Businesses Segment

- Operating result stood at € -227 million

The operating result of the Holding and other businesses segment was at € -227 million (€ -158 million 1H2023).

The operating result of Other businesses reached € 110 million (€ 154 million 1H2023) impacted by lower intragroup dividends, especially from France. Operating expenses grew by 8.3% mainly reflecting higher cost of share-based payments and IT projects.

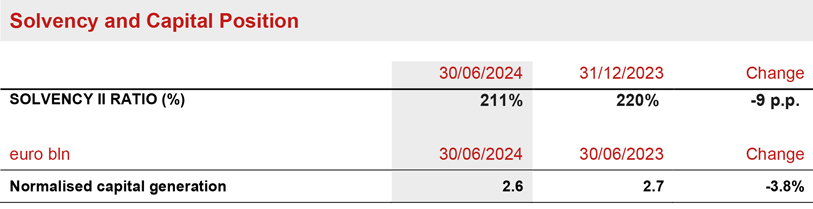

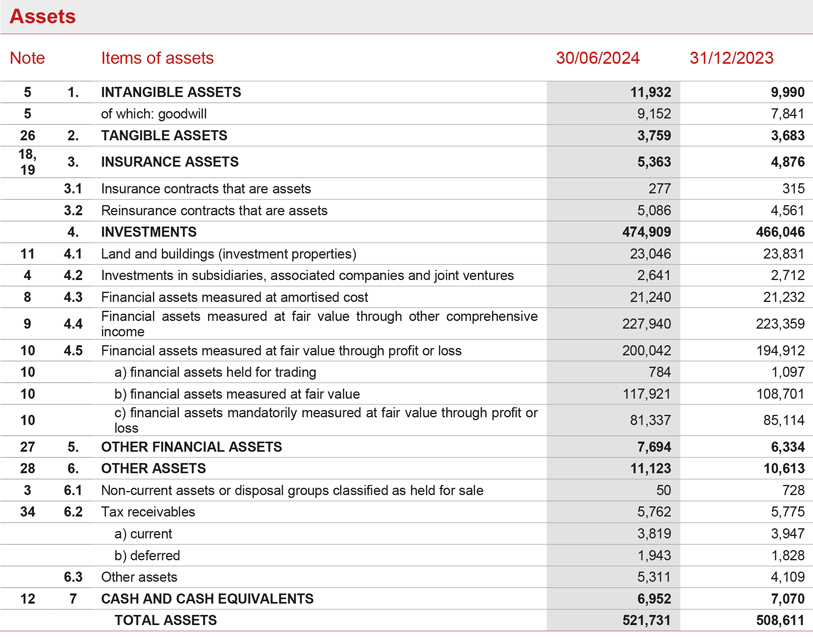

Balance Sheet and Capital Position

- Solid capital position with the Solvency Ratio at 211% (220% FY2023)

- Continued strong normalised capital generation at € 2.6 billion

The Group confirms a solid capital position with a Solvency Ratio at 211% (220% FY2023). The contribution of the normalised capital generation has only partially compensated the impact of M&A activity (-8 p.p. driven by the acquisition of Liberty Seguros), regulatory changes (-2 p.p. mostly due to EIOPA adjustments since the start of 2024), economic variances (-1 p.p.), operating variances (-2 p.p.) and capital movements (-7 p.p., reflecting the dividend for the period and the buy-back programme of € 500 million).

The normalised capital generation remained strong at € 2.6 billion (€ 2.7 billion 1H2023), supported by the positive contribution of both the Life and P&C segments, and also reflecting for the first time the share buy-back for the purposes of the Long-Term Incentive Plan (LTIP) as well as the Group's incentive and remuneration plans under execution.

Outlook

In the second half of 2024, global financial markets are expected to be affected by the timing and extent of central bank interest rate cuts. The Fed and the ECB may proceed cautiously in reducing their respective policy rates, despite persistent inflation in the services sector and continued high employment levels, which are gradually decreasing. Global economic recovery is proceeding at a moderate pace with the Eurozone likely to continue to show muted signs of recovery, despite geopolitical uncertainty and market volatility.

In this context and in line with the priorities set out in the ‘Lifetime Partner 24: Driving Growth’ strategic plan, the Group continues to execute its strategy to rebalance the Life portfolio to further increase profitability and allocate capital more efficiently. It will also maintain its focus on product simplification and innovation with the introduction of a range of modular product solutions, designed to meet customer needs and marketed through the most suitable and efficient distribution channels. Primary focus areas include protection and health, as well as capital-light hybrid products.

In the P&C business, the Group's objective is to maximise profitable growth, with a focus on the non-motor line – across its insurance markets, particularly strengthening its position and offering in markets with high growth potential. The Group also continues to pursue an adaptive approach towards tariff adjustments in both motor and non-motor, taking into account the increase in reinsurance coverage costs resulting from the increased natural catastrophe claims in recent years. The growth in P&C will continue with the aim of enhancing Generali’s leadership in the European insurance market for private individuals, professionals and small and medium-sized enterprises (SMEs), also benefitting from the recent acquisition of Liberty Seguros operations in Spain, Portugal and Ireland.

In the Asset & Wealth Management segment, following the acquisition of CHL completed on 3 April 2024, Asset Management will continue to implement its strategy with the objectives of expanding the product offering, particularly in real and private assets, enhancing third party distribution capabilities and extending its presence in new markets. In Wealth Management, Banca Generali group will continue to focus on the targets of growth, profitability and shareholder remuneration, as outlined in its strategic plan.

With reference to the Group’s investment policy, it will continue to pursue an asset allocation strategy aimed at ensuring consistency with liabilities to policyholders and increasing risk-adjusted current returns.

The Group confirms its commitment to pursue sustainable growth, enhance its earnings profile and lead innovation. This is in order to achieve a compound annual growth rate in earnings per share5 between 6% and 8% in the period 2021-2024, generate Net Holding Cash Flow6 exceeding € 8.5 billion in the period 2022-2024 and distribute cumulative dividends to shareholders for an amount between € 5.2 billion and € 5.6 billion in the period 2022-2024, with a ratchet policy on the dividend per share. With the payment of the 2023 dividend on 22 May 2024, the Group achieves the latter target reaching cumulative dividends in the period 2022-2024 of € 5.5 billion.

Significant Events After 30 June 2024

Significant events that occurred following the end of the period are available in the Half-Yearly Consolidated Financial Report 2024.

The Report also contains the description of the alternative performance indicators and the Glossary.

***

Q&A Conference Call

The Group CEO, Philippe Donnet, the Group CFO, Cristiano Borean, the Group General Manager, Marco Sesana and CEO Insurance, Giulio Terzariol, will host the Q&A session conference call for the consolidated results of the Generali Group as of 30 June 2024, which will be held on 9 August 2024, at 12.00 pm CEST.

To follow the conference call, in a listen only mode, please dial +39 02 8020927.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

Generali 2Q 2024 Results

Further Information by Segment

Balance Sheet

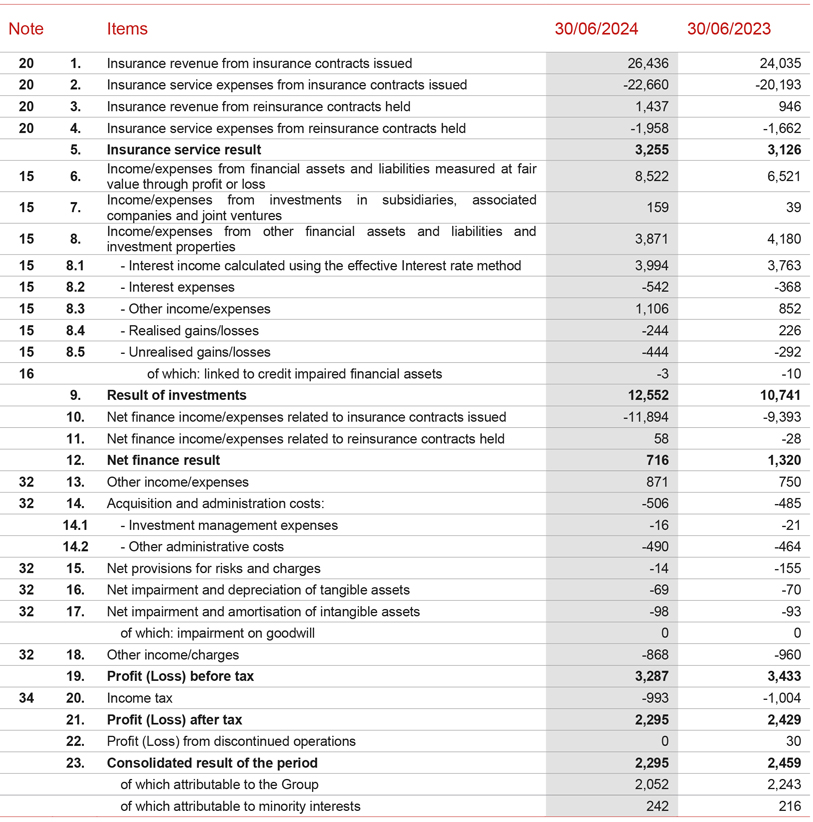

Income Statement

1 1H2023 figures have been restated considering: (1) LTIP and other share-based payments (including WeShare plan) have been moved from non-operating results to operating results; (2) AWM segment now includes all the operating and non-operating costs that were previously considered as holding expenses, including the aforementioned LTIP and other share-based payments. Changes in premiums, Life net inflows and new business are presented on equivalent terms (at constant exchange rates and consolidation scope). The amounts are rounded and may not add up to the rounded total in all cases. Also, the percentages presented can be affected by the rounding.

2 For definition of the adjusted net result, please refer to note 2 on page 2.

3 Including premiums from investment contracts equal to € 817 million (€ 776 million 1H2023).

4 French collective protection business underwritten in 4Q2023 with coverage starting in 2024 was deemed to be profitable and hence in line with IFRS 17 requirements, recognised entirely in 1Q2024. The majority of the business underwritten in 4Q2022 with coverage starting in 2023, was considered onerous and thus recognised earlier in 4Q2022.

5 3 year CAGR based on 2024 Adjusted EPS (according to IFRS 17/9 accounting standards and Adjusted net result definition currently adopted by the Group), versus 2021 Adjusted EPS (according to IFRS 4 accounting standards and Adjusted net result definition adopted by the Group until 2022).

6 Net Holding Cash Flow and dividend expressed on cash basis (i.e. cash flows are reported under the year of payment).