Navigating a Turbulent World

During social and climate emergencies, the role of insurance becomes crucial thanks to rapid and tailored responses in the compensation phase

We live in times of geostrategic, environmental, technological and demographic shifts, with a pace and magnitude of changes rarely seen before.

The Global Risks Report 2024, which surveys 1,500 global experts from academia, business, government, the international community and civil society about current and future risks affecting their organisations, shows a picture of complex and interconnected challenges, from conflict to environmental crisis and social imbalances. These threats are set against a backdrop of rapidly accelerating technological change and economic uncertainty faced by people in every region of the world.

This year’s report ranks concern about misinformation and disinformation as the top risk over the next two years, followed by extreme weather and societal polarization, while in a 10-year context, climate-related and environmental risks dominate the list. At closer look it becomes clear how risk can cascade through sectors and systems: floods can trigger damages through supply chains, loss of biodiversity can hamper the development of new medicines, and economic downturn can lead to societal polarization which may trigger the delay of policies and regulations to reduce environmental impacts. These complex interdependencies create instability and turbulent conditions for policy makers, businesses and society as a whole. Rather than quick fixes there is need for integrated solutions that deal with the cause, not only with the symptoms.

WHAT THE GLOBAL RISKS REPORT 2024 SAYS.

Not knowing what is happening is a more dangerous risk than the extreme events themselves

Addressing economic, social and environmental challenges together

The effort to balance economic, social and environmental considerations is hardly new. It is at the heart of the sustainable development concept, which emerged in the 1980s as a paradigm for responsible and forward looking decision-making. In 1983 the UN established a commission to consider global environmental aspects of development from economic, social and political perspectives. This led to the 1987 Brundtland commission report, which established the concept of sustainability as the process of formulating policy in the symbiotic relationship between economic growth, social fairness and environmental integrity. This has shaped the discourse on sustainability ever since. At its heart is the aim to reduce the trade-offs and enhance the co-benefits between a strong economy, a fair society and a healthy environment.

Worldwide a growing number of sectors now understand that a strategy that addresses social, environmental and economic challenges can enhance customer loyalty, attract talent, and provide a competitive edge. However, political uncertainty about regulation and unclear demand signals from consumers or investors need to be navigated carefully. Another challenge is the phenomenon of “greenwashing,” where companies exaggerate or falsely claim their environmental and social efforts to appear more sustainable than they are. This can lead to scepticism among consumers and investors, as stakeholders demand transparency and accountability. Importantly, the ability for a firm to be sustainable heavily depends on the leadership pushing for sustainability and overcoming corporate silos that impede the integration of sustainability into business practices (Metcalf and Benn (2013). The financial sector, including insurers, can play an important role in supporting corporates as well as the public sector in their sustainability efforts.

Insurance: Society’s risk manager

The insurance industry plays a crucial role in the global financial system, managing over $30 trillion in assets while providing essential risk management for individuals, businesses, and governments. Historically, it has contributed significantly to safety improvements, such as reducing fire hazards and enhancing road safety. As a vital risk manager, the insurance sector faces both challenges and opportunities from societal risks. While it serves as a defense against threats, the industry’s capacity to insure is not unlimited and comes at a cost. Claims on insured assets can lead to increased premiums and affect profitability.

Consequently, insurers must closely monitor emerging risks and trends to pre-emptively address potential crises. Indeed, a core role for insurance as society’s risk manager is to raise red flags and challenge the rest of the system to change course before threats become unmanageable. This makes the sector a natural champion for resilience. The concept of resilience—defined as the ability to anticipate, adapt, and respond to risks sustainably—has become central to the insurance industry’s mission. By proactively identifying risks related to environmental, social, and governance factors, insurers can help society navigate uncertainties and minimize adverse impacts. This includes evaluating threats like climate change and regulatory shifts. The insurance sector not only safeguards against financial losses but also fosters resilience by encouraging proactive risk management strategies that create long-term value for stakeholders. By understanding these risks, society can develop robust plans and build resilience, for example in the context of physical climate risks and nature loss.

It’s encouraging: 90% of companies are discussing climate adaptation strategies. By taking a holistic approach, business leaders can increase resilience to climate risks.

Demonstrating resilience to the physical risks of climate change as a key sustainability strategy

Climate change is significantly impacting society and economies across various sectors and regions, affecting life and livelihoods, employee wellbeing, damaging assets, and disrupting operations and supply chains. The increasing frequency and intensity of extreme weather events—such as wildfires, windstorms, floods, and droughts—pose substantial risks. Key examples include:

- Excessive heat: rising temperatures threaten employee health, compromise the quality of perishable goods, and damage infrastructure like asphalt, which can hinder transportation.

- Water stress: this growing concern is impacting global supply chains, particularly in agriculture, manufacturing, and energy production.

- Intense rainfall: severe weather can lead to power outages and property damage; for instance, record rainfall in April 2024 resulted in a $110 million loss for Emirates Airlines.

As climate change continues to escalate, these disruptions are expected to worsen. The Marsh McLennan Flood Risk Index highlights vulnerabilities, indicating that currently, 18% of international airport capacity and 26% of trade outflows through ports are at risk of flooding. With a projected 2°C increase in global temperatures, these figures could double, further straining businesses and communities. In the face of these trends, adaptation is crucial; it does not imply defeat but is essential for responsibly addressing the ongoing crisis. Ignoring the need for adaptation will complicate future risk management efforts. A recent Marsh survey found that understanding of risks and their impacts is growing, but still limited: while many companies currently assess climate risks qualitatively, nearly half do not quantify their impacts effectively. Encouragingly, 90% have begun discussing climate adaptation strategies. By adopting a holistic approach to risk management—including enterprise risk management and supply chain management—business leaders can develop robust adaptation strategies that enhance resilience against current and future climate risks. Insurance can play a key role in this, by combining its financial risk transfer role with the promotion of practical risk reduction. To highlight their role in societal risk reduction, the International Cooperative and Mutual Insurer Federation (ICMIF) and the United Nations Office of Disaster Risk Reduction (UNDRR) recently launched the ICMIF Prevention Hub. This platform outlines several ways in which insurers can reinforce risk reduction signals, showcasing over 60 case studies ranging from Building Back Better strategies after a claims event to risk engineering and collaboration on risk data sharing and awareness raising. Implementing these can be challenging for insurers. But faced with multiple risk drivers and ever-more complex risk trends, the industry is starting to realize that risk management needs to be transformed to be more forward-looking and cross-cutting, tackling the underlying risk drivers; and framing risk management as an in - vestment opportunity (Marsh McLennan 2023).

Insurers can help society realise sustainability co-benefits: the example of nature-based solutions

Nature-based solutions (NbS) offer a promising approach to tackle the risks of climate change and nature loss. Unlike traditional hard engineering solutions, NbS focus on utilizing the inherent benefits of nature itself. These solutions involve actions to protect, manage, and restore natural ecosystems, providing societal and biodiversity benefits while effectively addressing risks. If well implemented and managed, NbS can not only aid in adapting to climate change but also offer economic gains and opportunities for emission reduction through carbon sinks as well as wider social benefits to local communities.

For example green infrastructure, such as wetlands and green spaces, can mitigate climate impacts and alleviate the strain on drainage systems. Implementing interconnected networks of wetland areas on a larger scale can further enhance resilience.

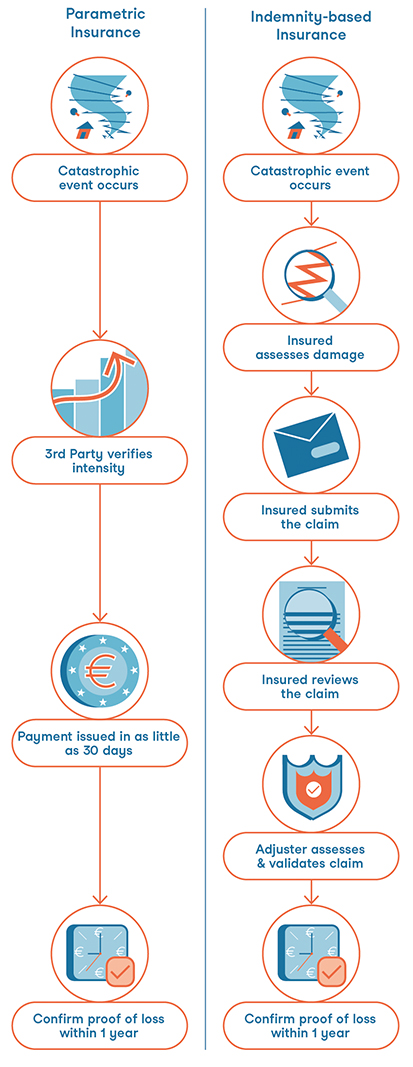

Risk transfer can play a vital role in reducing businesses’ impact on nature and building corporate resilience to nature loss. Existing insurance solutions, such as Environmental Impairment Liability (EIL), Directors’ and Officers’ (D&O) insurance, and Business Interruption (BI) insurance, are being adapted to address nature-related vulnerabilities. Additionally, innovative solutions like parametric insurance are being explored. Technological advancements in remote sensing and modelling enable underwriters to expand coverage to new risks, including biodiversity loss. Parametric insurance emerges as a powerful tool for risk transfer and resilience-building in the face of climate change. When properly designed, parametric insurance offers swift payouts based on predefined criteria, facilitating rapid financial recovery after extreme weather events. Recent advancements in data collection, remote sensing, and analytics have paved the way for tailored parametric insurance products, bridging gaps left by traditional insurance models. Examples include community-based catastrophe insurance in New York City, rainfall-indexed drought coverage for smallholder farmers, and extreme heat in - come insurance for women workers in India. Parametric solutions also hold promise in preserving ecosystems and reducing insurance premiums related to climate risks.

As awareness of nature-related risks grows, the potential of parametric insurance solutions expands. These products can complement traditional insurance methods by providing additional coverage for environmental liabilities and business interruptions. However, successful implementation requires supportive regulatory frameworks and integration with broader resilience strategies. Public-private partnerships play a crucial role in establishing a sustainable private insurance market that enhances financial resilience and widens coverage options. By combining risk reduction measures with parametric solutions, initiatives like the CBCI pilot project exemplify how integrated approaches can bolster climate resilience in vulnerable communities. (Rooted in Resilience, 2023)

This is still an emerging area and there are significant barriers to mainstreaming the adoption of nature insurance solutions, such as lack of data and regulatory issues. It suggests that new models of collaboration and investments in analytics and risk management systems are needed to foster innovation and bring new insurance solutions to scale. Initiatives, such as Naturance, are designed to help overcome these: Naturance, established by the EU Horizon Europe Research and Innovation Framework, aims to evaluate the feasibility and performance of solutions to climate and biodiversity crises. By integrating disaster risk financing with nature-based solutions, Naturance explores “nature-based investment and insurance solutions,” recognizing the value of ecosystem services and translating them into financial instruments like insurance, insurance-linked securities, and resilience bonds.

THE SIMPLIFICATION

More science, less bureaucracy

Conclusion

In a world facing unprecedented challenges from environmental risks and climate change, the role of insurance in building resilience and addressing these issues has become increasingly crucial. The insurance industry, with its vast assets and risk management expertise, plays a vital role in steering society towards more resilience. It can raise red flags and challenge the rest of the system to change course before threats become unmanageable. This includes evaluating threats like climate change, extreme weather events, and regulatory shifts. In order to continue safeguarding society against financial losses the industry also needs to foster resilience by encouraging proactive risk management strategies, including the adoption of NbS. The insurance industry can play a vital role in supporting the implementation of NbS by adapting existing insurance solutions and exploring innovative approaches like parametric insurance. These solutions provide additional coverage for environmental liabilities and business interruptions, facilitating swift financial recovery after extreme weather events and promoting resilience.

As businesses and society as a whole become increasingly aware of the risks posed by climate change and environmental degradation, the insurance industry has a unique opportunity to lead the way in promoting resilience and sustainability. By embracing insurance as a catalyst for change, businesses can enhance their risk management strategies, build resilience, and contribute to a more sustainable future. Through collaboration, innovation, and a shared commitment to addressing environmental risks, we can navigate the turbulent world we face and build a more resilient and sustainable society for generations to come.

Prof. Swenja Surminski

Climate and Sustainability Manager at Marsh McLennan, she teaches at the Grantham Institute on Climate Change and the Environment, London School of Economics and Political Science (LSE).