Double Materiality Assessment

The Double Materiality Assessment is the strategic process through which Generali Group identifies the material sustainability matters on which it will focus its actions in order to create long-term value while driving a positive impact on people and the planet.

We have conducted a materiality assessment at least every 3 years since 2014. Our methodology has been refined over the years to align with the context and regulatory developments.

In 2024, we developed a new methodological approach, in compliance with the provisions of Legislative Decree 2024/125 which implements Directive 2464/2022/EU (Corporate Sustainability Reporting Directive - CSRD) and the European Sustainability Reporting Standards (ESRS). In particular, the CSRD introduced the concept of double materiality, which represents a significant shift in the process of identifying material topics. This new approach requires the evaluation of sustainability matters from a double perspective: impact materiality, meaning the positive and negative impacts generated on people and the environment, and financial materiality, meaning the risks and opportunities that influence or might influence the development and financial performance of Generali.

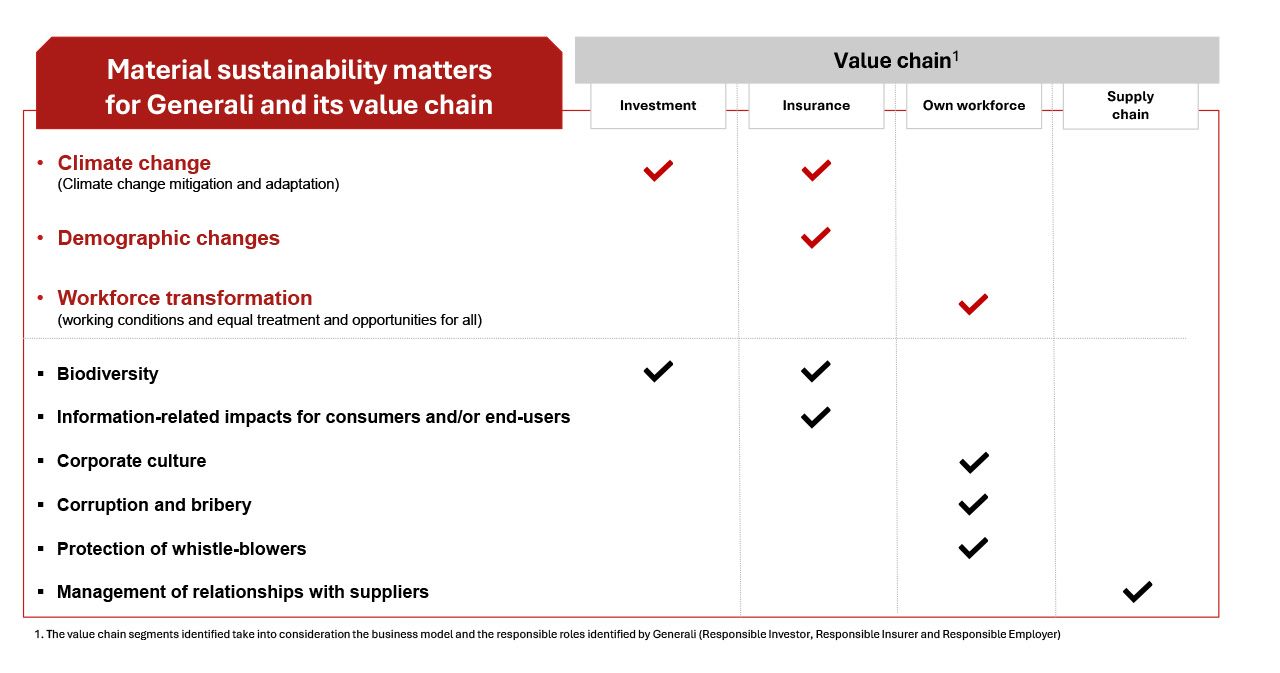

Additionally, the CSRD requires these evaluations to be conducted across the entire value chain. Here, Generali has identified in four relevant segments, taking into account its business model and responsible roles: investments, insurance, own operations, and supply chain.

Through the Double Materiality Assessment, Generali identified material impacts, risks, and opportunities across our value chain. These outputs provide the basis for our 2024 Group Sustainability Statement. Furthermore, the outcome of the Double Materiality Assessment were used as key input for the new strategy Lifetime Partner 27: Driving Excellence. This process allowed the identification of the following topics which, besides being material, are also strategic for the Group: climate change, demographic changes and workforce transformation.

| Strategic Priorities | CSRD-ESRS Topic/sub-topic | SDGs |

|

Climate change |

E1 – Climate change

|

|

|

Demographic changes |

S4 – Consumers and end-users

|

|

| Workforce transformation |

S1 – Own workforce

|

|

The link between the Double Materiality Assessment and the strategy definition process allows the Group to orient its sustainability targets to better manage the impacts associated with its business model, manage the risks and pursue the opportunities identified.

Climate change *

Why it is strategic for Generali: climate change mitigation refers to efforts to reduce or prevent the emission of greenhouse gases in order to limit the increase in global temperature. Since the beginning of the industrial revolution, the global average temperature has increased by 1.48°C compared to pre-industrial levels (1850-1900). This phenomenon is mainly caused by the increase in greenhouse gas concentrations in the atmosphere, resulting from the use of fossil fuels. To avoid the worst effects of climate change, the 2015 Paris Agreement set the goal of limiting the global temperature increase to well below 2°C, with efforts to keep the increase within 1.5°C. For financial companies like the Generali Group, contributing to climate change mitigation becomes an absolute priority, both to reduce the negative impacts caused by their business on the external world and to mitigate the financial risk they face.

| CSRD-ESRS Topic/sub- topic |

Value Chain | Double materiality assessment output for CSRD purposes |

|

E1 – Climate change Climate change mitigation |

Investment |

|

| Insurance |

|

Why it is strategic for Generali: climate change adaptation refers to measures taken to protect society and the environment from the negative effects of global warming, such as the increased frequency and severity of extreme weather events. In 2024, estimated global economic losses from natural events were $ 310 billion, of which 56% was uninsured, highlighting the need for adaptation solutions to protect individuals and businesses. It becomes a priority Generali to contribute to the resilience and adaptation of the communities in which it operates, which increasingly face the consequences of extreme events, as well as to mitigate the financial risk that Generali might suffer as a result of these same events.

| CSRD-ESRS Topic/sub- topic |

Value Chain | Double materiality assessment output for CSRD purposes |

|

E1 – Climate change Climate change adaptation |

Investment |

|

| Insurance |

|

Demographic changes *

Why it is strategic for Generali: addressing the growing gaps in healthcare and pension systems becomes a priority, particularly for the insurance sector. This is important both because the business could contribute to increasing social resilience and because addressing the consequences of demographic changes could have a positive impact on communities, as well as represent an opportunity for the Group.

| CSRD-ESRS Topic/sub- topic |

Value Chain | Double materiality assessment output for CSRD purposes |

|

S4 – Consumers and end-users Demographic changes |

||

| Insurance |

|

Workforce Transformation *

Why it is strategic for Generali: Generali is a human-centric Group that considers it essential, also for developing a solid sustainability strategy, to work on building a resilient workforce that best responds to future challenges, in line with its role as a Responsible employer. The Group aims to further strengthen its focus on sustainability as a fundamental part of its mission, both by leveraging and further strengthening its cultural framework, promoting knowledge and sustainable work practices, and investing in people’s skills. In recent years, the Group has adopted hybrid work models and witnessed the evolution of workforce demographics, which now include four generations, increasingly oriented to social and environmental aspects. Working on Diversity, Equity and Inclusion (DEI), on the well-being and energy of the Group’s employees and on the promotion of sustainability has therefore become even more important to ensure their engagement. Furthermore, generational shift, together with a rapid technological evolution, require a strategic approach to workforce planning and a further evolution of the training offering to maintain or increase our people professional relevance in a rapidly changing environment.

| CSRD-ESRS Topic/sub- topic |

Value Chain |

Double materiality assessment output for CSRD purposes |

|

S1 – Own Workforce Working conditions; |

||

| Own operations |

|

Biodiversity

| CSRD-ESRS Topic/sub- topic |

Value Chain | Double materiality assessment output for CSRD purposes |

|

E4 – Biodiversity and ecosystems Direct impact drivers of biodiversity loss; |

||

| Investment |

|

|

| Insurance |

|

Information-related impacts for consumers and/or end-users

| CSRD-ESRS Topic/sub- topic |

Value Chain | Double materiality assessment output for CSRD purposes |

|

S4 – Consumers and end-users Information-related impacts for |

||

| Insurance |

|

Corporate Culture

| CSRD-ESRS Topic/sub- topic |

Value Chain |

Double materiality assessment output for CSRD purposes |

|

G1 – Business conduct Corporate culture |

||

| Own operations |

|

Corruption and bribery

| CSRD-ESRS Topic/sub-topic | Value Chain | Double materiality assessment output for CSRD purposes |

|

G1 – Business conduct Corruption and bribery |

||

| Own operations |

|

Protection of whistle-blowers

| CSRD-ESRS Topic/sub-topic | Value Chain |

Double materiality assessment output for CSRD purposes |

|

G1 – Business conduct Protection of whistle-blowers |

||

| Own operations |

|

Management of relationships with suppliers

| CSRD-ESRS Topic/sub- topic |

Value Chain | Double materiality assessment output for CSRD purposes |

|

G1 – Business conduct Management of relationships with suppliers |

||

| Supply chain |

|

* Strategic priority

The identification of material impacts, risks, and opportunities followed a structured process that involved both internal and external stakeholders

1. Pre-assessment

Once the main methodological choices underlying the Double Materiality Assessment had been defined, a preliminary analysis was carried out on each topic under analysis*, for each of the four segments of the value chain.

Each topic analysed was assessed from both an impact and a financial perspective.

Where available, Generali relied on internal data and analysessuch as climate scenario analysis, operational risk assessments, metrics, and existing targets. In addition,, external data and information from data providers, industry studies and market-recognized institutions/associations and expert judgement of key function involved were used.

* For the analysis, the sub-topics related to the 10 topics identified by the ESRS were considered, in addition to further entity-specific topics based on Generali's business, industry trends, and previous materiality assessments carried out by the Group.

2. Feedback collection

The second phase involved direct engagement with internal and external stakeholders to identify the impacts, risks and opportunities that are material to Generali and its value chain.

The results obtained in the pre-assessment phase were reviewed and validated by internal functions of the Group, as well as by the Sustainability Taskforce to assess their soundness and consistency. To include a local view, sustainability representatives from over 40 Countries in which Generali operates were engaged via a tailored survey.

In addition, we actively involved selected external stakeholders, who provided a significant external perspective to integrate material topics into the Group’s business model and strategy. The stakeholders were engaged via individual interviews with the aim of presenting the results and gathering any further feedback and comments.

Once all the feedback received during the analyses had been collected and consolidated, the final results of the Double Materiality Assessment were shared individually with the members of the Top Management (Group Management Committee - GMC) to gather further feedback on the results of the analyses and the strategic implications.

3. Final validation

Both the methodology and the results were formalized and presented to the Top Management and the Innovation and Sustainability Committee (ICS) respectively. Subsequently, the final results were presented to the Board of Directors of Assicurazioni Generali S.p.A., which approved them on 20 May 2024.