Statement

04 February 2025 - 08:00

Milan – The transaction announced by Generali on January 21, 2025, relating to the establishment of a partnership in asset management with Natixis Investment Managers (Natixis IM) and its parent company Groupe des Banques Populaires et des Caisses d'Epargne (BPCE), has been the subject of much press and market attention.

This Press Release therefore aims to clarify the strategic rationale and provides more additional information as well as some relevant items of the agreements executed among the parties.

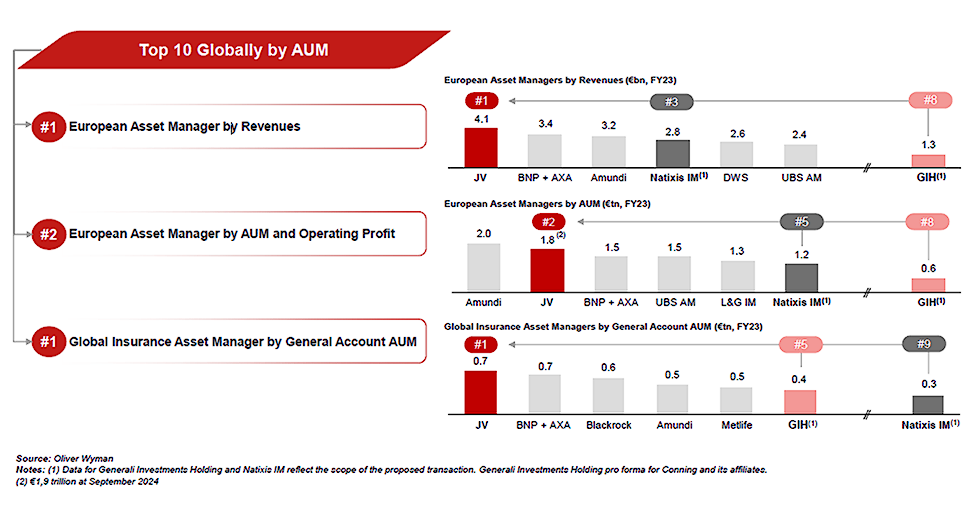

As announced, the new company (“NewCo”) would combine the asset management activities of Generali Investments Holding and Natixis Investment Managers (Natixis IM) establishing a global operator with €1.900 billion in assets under management, ranking ninth globally and leading in European asset management with €4.1 billion in revenues.

The newly formed company would be co-controlled by both financial institutions, each holding a 50% stake, operating under a joint governance structure with equal representation and control criteria.

Generali Investments Holding would contribute over €600 billion in assets, while BPCE, through Natixis IM, would contribute €1.300 billion. This would result in the creation of a cross-border European leader in asset management, with significant presence in the US and a potential for growth in Asia, jointly led by Generali from Italy and BPCE from France. The company would also be the world's leading operator in managing assets for insurance clients, with the aim of developing the platform as a global leader and further expanding in this growing segment.

The new entity would be ideally positioned to further expand its activities for third-party clients, also thanks to Generali's commitment to contribute a total of €15 billion in so-called Seed money over the first five years to launch new initiatives and investment strategies, primarily in the alternative investments segment (particularly in private markets), to further expand existing expertise and product offerings to best meet the increasingly sophisticated investment demands of clients.

Generali’s Seed money activities consist of the subscription of funds and investment mandates, regulated and consistent with Generali's independently defined asset allocation for insurance assets managed by the Group – which count to date over €460 billion – on behalf of its clients and always in their best interest, with careful examination and evaluation of the management costs and expected returns against the risks undertaken.

The objective is to pursue – always consistent with the strategic investment guidelines and asset allocation independently defined by Generali – growth opportunities in new segments and to promote a further expansion of existing skills and product offerings, in order to better meet the increasingly sophisticated investment demands of clients.

Seed money is not a new concept for Generali: the Group already has a seeding policy enabling the investment of a portion of its insurance portfolios for launching new strategies deemed high-potential and consistent with the Group's insurance portfolio allocation objectives. Generali has invested about €20 billion of Seed money, and approximately €5 billion were already planned for 2025, regardless of the transaction with Natixis IM.

The source of this Seed money includes cash flows of approximately €25 billion generated by Generali’s insurance portfolios each year between redemptions of maturing securities, coupons and dividends that are reinvested in the various asset classes. In addition, Generali has a three-year target (from the 2025-2027 Strategic Plan) for net inflows on life insurance products of €25-30 billion. It is therefore clear that the commitment of €15 billion cumulative over 5 years represents a minority share of both Generali's total assets under management and annual reinvestment flows.

The combination with Natixis IM offers a unique value creation opportunity for the Generali Group, estimated to exceed €1 billion. This estimate reflects the present value of the expected economic benefit from Seed money and the synergies expected from the transaction, net of integration costs and higher taxes. Revenue synergies and operational efficiencies have been identified, totalling €210 million annually pre-tax (at regime1), deriving from greater growth potential and cross-selling opportunities, in addition to cost-saving initiatives (particularly at the central level) which would provide ample scope for efficiencies in areas such as procurement, IT and data management, benefitting from the enhanced scale of the combined platform.

This estimate of €210 million synergies does not include the expected contribution from the future deployment of Seed money, which could contribute to the development of the customer base and a further increase in estimated revenues through the launch of new high-potential products.

The definition of Group adjusted net result excludes, among other items, the impact of any amortization of intangibles related to client relationships, as well as any profit and loss resulting from M&A.

The pro forma2 adjusted net result of Generali Investment Holding as at 2023 stood at €0.3 billion.

The proposed transaction announced on January 21, 2025, would result – at closing – in a realized profit for the Generali Group estimated in the region of €1 billion (according to IAS 28) which would be neutral on the calculation of the Group adjusted net result.

The proposed transaction would also result in an overall impact of €25 and 50 million including Costs To Achieve (“CTAs”) over the first 2 years, excluding the impact of the preferential dividend provided for the first 2 years only and for a total amount of €250 million. Such preferential dividend in favour to BPCE would lead the overall impact for the Generali Group (net of taxes) in the region of -€25 and 0 million. After the period affected by the preferential dividend distribution, i.e. from 2028 onwards, the impact on the adjusted net result is estimated to be over €50 million, including CTAs. Once CTAs have been incurred in full, and synergies reach run-rate, the impact on the adjusted net result would be higher than €125 million per year, starting from 2030.

The net impact on remittance from Generali’s group subsidiaries is estimated to be negative for around €100 million cumulatively over the 2025-2027 Strategic Plan horizon, mostly due to CTAs and ancillary costs. The impact on cash would benefit from a positive cumulative impact of over €100 million stemming from the repayment of a loan of around €230 million, to be granted by the Parent Company to Generali Investments Holding in order to finance the acquisition of MGG announced on January 17, 2025, and whose repayment would be the responsibility of NewCo which will be owned 50% by Generali Investment Holding. On a run-rate basis, the expected positive impact on cash for Generali would be in line with the expected impact on profit, once all synergies are realised.

Generali's goal, shared by BPCE, is clear: to build a solid long-term partnership consistent with its strategic vision, taking advantage of a unique value creation opportunity for the Group and all its stakeholders. In line with this, and to ensure stability and continuity to the project, Generali and BPCE would sign a 15-year agreement which would regulate the terms and conditions of management by the asset managers of NewCo of their own assets, claiming substantial continuity of the contractual terms of the management proxies in place to date, and which would therefore not entail – for the Generali Group – changes as to the commission flows paid.

Safeguard clauses are provided for both parties, and any commitments remain subject to compliance with all applicable regulations, autonomy of Generali and of the insurance companies in their asset allocation choices and safeguarding the best interests of their clients. It is also expected that Cathay Life, already bound by a long-term management agreement with Generali Investments Holding, would renew its commitment to NewCo.

Management of assets contributed by Generali: how investment governance works

Whereas, to date, assets under management pertaining to companies and Italian clients of the Generali Group represent around 30% of the total assets managed by Generali Investments Holding, the creation of the partnership would have no impact on the continuity of savings management policies entrusted by Italian clients to the Generali Group's companies, which remain the owners of the assets and decide on their allocation among the various investment strategies.

The assets would remain subject to all the rigorous safeguards provided by the legislative and regulatory framework in force at both national and European prudential levels, within precise and stringent risk limits.

Each of the two partners would retain full and exclusive decision-making power over their respective assets managed by NewCo. This means that Generali and its BoD – just as it is the case today – will continue to define the strategic investment guidelines and asset allocation for the entire Group.

- The investment decision-making process adopted by the Generali Group provides that it is the Parent Company and its BoD that define the strategic investment guidelines for the entire Group (while the individual insurance companies with their respective BoDs define their own strategy in line with the Group's overall strategy), including the assignment of management mandates containing well-defined risk limits and objectives which the manager must adhere to, such as indicating the countries, asset classes or, for example, government bonds in which to allocate investments. For instance, it is the insurance company that decides what is the expected allocation in Government Securities and the respective share to be allocated among the various countries, giving specific indication to the asset manager that remains bound to this choice. In light of the foregoing, the transaction with BPCE will have no impact on the allocation to BTPs of the Generali Group;

- the Chief Investment Officer (CIO) of the Generali Group proposes the so-called strategic asset allocation to the Assicurazioni Generali's BoD, and once approved, implements it and ensures continuous monitoring of the managers' performance. The process is mirrored at the level of the individual insurance company of the Generali Group, whose CIO has a direct reporting line to the Group CIO;

- the delegated managers, i.e. the asset management companies, implement the investment strategy thus defined by identifying the individual securities providing the best fit with the strategy, producing research on investments and tactical allocation, as well as executing orders on the market etc. These are, therefore, companies providing a service to the Group's insurance companies that operate within stringent limits and objectives set by the Parent Company and the companies concerning investment allocation;

- the portfolio management contracts or IMAs ("Investment Management Agreements") entered into between the insurance companies and the asset managers bind the manager to comply with the applicable rules for managing insurance portfolios as well as specific investment strategies and management guidelines indicated by the companies, which can still terminate at any time. The asset management companies are therefore required to carry out investments in compliance with the objectives (and correspondingly the constraints) defined by the insurance companies. These mandates allow the companies to issue instructions on specific classes and operations, restricting the scope of actions and avoiding exposures to specific risk sources;

- all this would not change with the transaction, which also includes specific protections for historical or strategic real estate assets under management included in funds.

The Impact of the Agreement on Generali’s Tax Contribution Levels in Italy

From a tax perspective, there would be no transfer of value outside Italy, nor would there be a reduction in taxes paid in Italy. It is indeed plausible that the Italian tax burden would increase, at least due to two factors:

- the creation of another level in the corporate chain in Italy, resulting in further taxation of dividends;

- the increase in expected taxable dividends for Generali due to the creation of value generated by NewCo.

The signing of the MoU and the employee representative bodies information and consultation procedure

In order to comply with the obligation to consult in advance with the employee representative bodies in connection with initiatives that may involve changes in the economic or legal organisation of the company involved in a transaction (sales, transfers of business, etc.), in the case of transactions involving (also) the French market, it is common practice to sign a preliminary document, usually a memorandum of understanding (“MoU”), by which the parties involved in a transaction declare that their negotiations are sufficiently advanced to initiate the applicable consultation process(es), and then proceed to the execution of the final agreements once the consultation procedures are completed.

Both groups involved in the proposed partnership have employee representative bodies in France (as well as in other countries) and are therefore required to conduct consultation procedures before making final binding commitments in relation to the envisaged transaction.

Following the signing of the MoU, each group (Generali and BPCE) will carry out its own consultation procedures. Once these are concluded, each shall inform the other party and indicate whether it intends to proceed with the signing of the final agreements (the “Confirmation Notice”) or not. If either group sends a Confirmation Notice indicating its decision not to pursue the transaction or fails to send a Confirmation Notice at all, then the MoU shall terminate automatically without any obligation for either group to consummate the transaction (without prejudice for the break-up fee). It is only upon transmission of Confirmation Notices by both groups indicating their intention to pursue the transaction that the parties to the MoU execute the definitive agreements.

The MoU also provides for a material adverse effect clause, according to which the entry into the definitive agreements is subject to the non-occurrence of any material adverse effect, meaning events which (i) might reasonably materially impair the ability of the parties to consummate the envisaged transaction within the agreed timeframe; or which (ii) have, or would reasonably be expected to have material adverse effect on the net result, asset under management or liabilities of the companies to be contributed to the new entity.

While the MoU does not bind the parties to the execution of the transaction, it provides for:

- undertaking to initiate and carry out the applicable employee representative bodies’ consultation process(es), to discuss, integrate and finalize at the same time the transaction documentation (on the basis of the drafts annexed to the MoU), and to carry out certain limited confirmatory due diligence and analyses;

- an exclusivity clause, applicable for the entire duration of the MoU and up to 9 months following the termination of the MoU;

- a break-up fee, for an amount equal to €50 million (also to compensate for the costs incurred in organizing and negotiating the transaction), payable by each party when 1) it did not undertake its consultation procedures following the signing of the MoU or if such procedure was not successfully carried out before July 31st, 2025, 2) it did not confirm its intention to pursue the envisaged transaction following the consultation procedures, or when 3) actions taken or omissions of a party have resulted in the occurrence of a material adverse effect.

Information flows and information rights of future partners

The risk and compliance framework of NewCo (and of the subsidiaries) is intended to be defined in such a way that, in addition to meeting all legal and regulatory requirements applicable to NewCo, it qualifies as “best in class” in terms of soundness and competitiveness based on the highest standards applicable in the asset management sector.

As for reporting, a flow of information will be ensured to the Generali Group and the BPCE Group to enable each of them to fulfill all legal and regulatory obligations and ensure proper risk management.

It shall be noted that the perimeter covered by the transaction does not include Natixis IM's shareholding to date in H2O Asset Management, and therefore NewCo would not be exposed to any past and/or future risks associated with it.

Governance of NewCo

The Board of Directors of the new entity would be composed of an equal number of directors appointed by Generali Investments Holding3 and Natixis IM (i.e., 6 members appointed by each partner), supplemented by three independent directors jointly selected by Generali Investments Holding and Natixis IM, along with the CEO of NewCo.

NewCo would be established in Amsterdam, the Netherlands, as a neutral solution between the two partners based in different countries.

Italy, France, and the United States would remain the operational hubs of NewCo, from which business activities would continue to be directly managed.

With reference to the company’s top management roles, it should be noted that the CEO (with broad management powers) heading NewCo at the time of its establishment would be the current CEO of Generali Investments Holding, appointed for a period of 5 years and automatically renewed for a further 5 years if the results achieved are in line with the company's business plan. Generali Investments Holding would also appoint the Vice Chairperson, while Deputy CEO and Chairperson would be assigned to Natixis IM, again for the first 5 years from the establishment of NewCo (and for a further 5 years if the mandate of the first CEO is renewed).

After a certain period of time, customary exit mechanisms would apply to allow and regulate any exit from NewCo. It is however not Generali’s intention to – nor are there any contractual provisions that could compel it to – reduce its stake or governance rights in NewCo.

1 To be achieved within a five-year period.

2 Data pro forma for the scope of the proposed transaction, including Conning and its affiliates but excluding MGG and its affiliates, before the transaction.

3 Cathay does not have a right of appointment of any board member of NewCo.