Generali Group consolidated results as at 31 December 2024

13 March 2025 - 07:00 price sensitive

Generali overdelivers on “Lifetime Partner 24: Driving Growth” plan targets and achieves record operating and adjusted net result

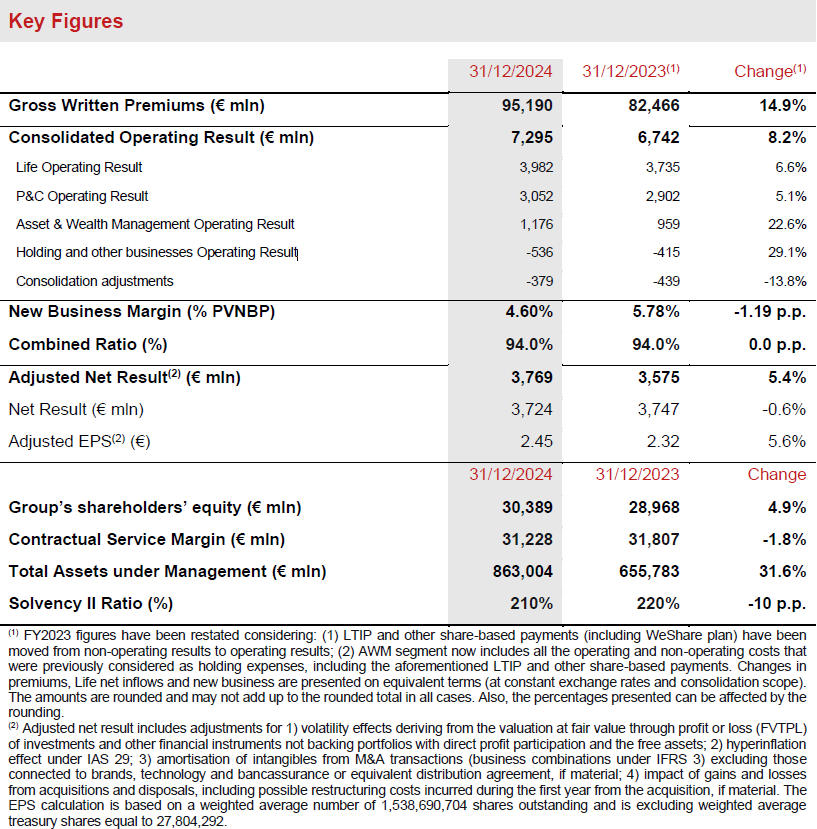

- Gross written premiums increased significantly to € 95.2 billion (+14.9%) with strong growth in Life (+19.2%) and P&C (+7.7%)

- Life net inflows reached very positive levels at € 9.7 billion entirely driven by protection and unit-linked. New Business Value grew to € 2.4 billion (+2.3%)

- Combined Ratio (CoR) maintained at 94.0% (0.0 p.p.) with an improved undiscounted CoR at 95.9% (-0.8 p.p.) thanks to strong attritional CoR performance

- Continued growth in operating result to a record € 7.3 billion (+8.2%), led by all business segments with a strong contribution from Asset & Wealth Management

- Adjusted net result rose to € 3.8 billion (+5.4%), an all-time record for the Group

- Total Assets Under Management reached € 863 billion (+31.6%) thanks to positive net inflows and the consolidation of Conning Holdings Limited

- Solid capital position, with Solvency Ratio at 210% (220% FY2023), primarily reflecting M&A transactions and the 2024 € 500 million buy-back programme

- Proposed dividend per share of € 1.43 (+11.7%) confirms strong focus on increasing shareholder remuneration in the “Lifetime Partner 27: Driving Excellence” plan

Generali Group CEO, Philippe Donnet, said: “Generali achieved excellent results in 2024, over-delivering against our financial targets and successfully bringing our ‘Lifetime Partner 24: Driving Growth’ strategic plan to a close. These results further reflect our ability to ensure consistent organic growth in each segment through the management actions we put in place, while successfully integrating all the businesses we have been acquiring. The Group today is in the strongest position in its history, demonstrated by our record operating and adjusted net results, achieved thanks to the efforts and commitment of our people and distribution network. We continue to transform and diversify our Group as a leading global integrated insurer and asset manager and are now focussed on accelerating our pursuit of excellence. Our ambitious new ‘Lifetime Partner 27: Driving Excellence’ plan will drive strong earnings growth, solid cash generation, and increased shareholder remuneration. This is further boosted by our AI and data capabilities enhancing our ability to consistently capture opportunities from fast-changing customer needs and emerging trends.”

Executive summary

Milan - At a meeting chaired by Andrea Sironi, the Generali Board of Directors approved the consolidated financial statements and the Parent Company’s draft financial statements for the year 2024.

Gross written premiums rose to € 95.2 billion (+14.9%), thanks to significant growth in both Life and P&C.

Life net inflows were very positive at € 9.7 billion entirely driven by protection and unit-linked, in line with the Group’s strategy, reflecting the strong product offering and the Group’s highly effective distribution network.

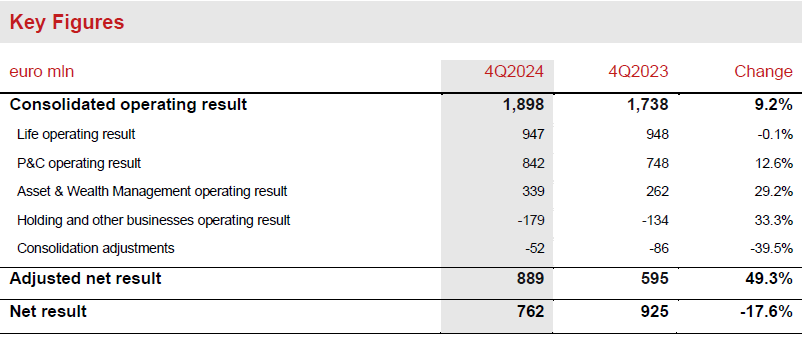

The operating result grew to a record € 7,295 million (+8.2%), thanks to the positive performance of all business segments, including a significant contribution from Asset & Wealth Management.

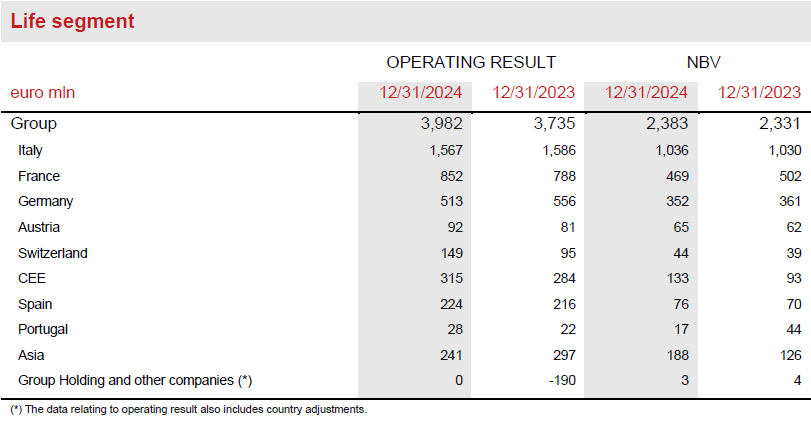

For Life, the operating result increased to € 3,982 million (+6.6%) and the New Business Value improved to € 2,383 million (+2.3%).

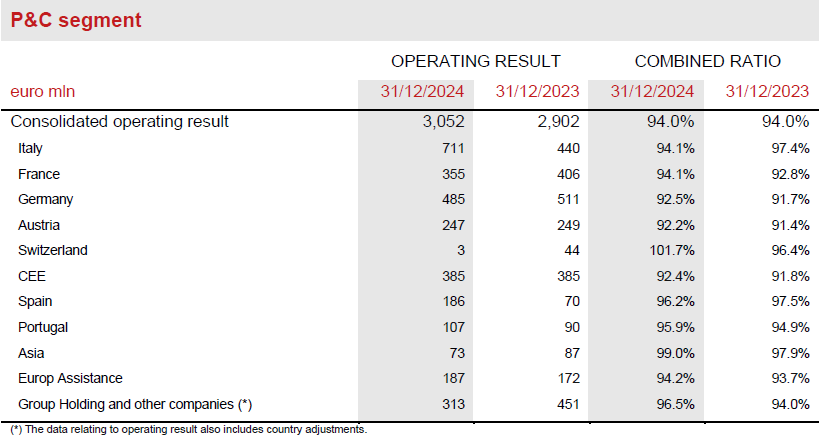

P&C operating result grew to € 3,052 million (+5.1%) with the Combined Ratio confirmed at 94.0% despite a lower benefit from discounting. The undiscounted Combined Ratio was 95.9%, achieving a 0.8 p.p. improvement compared to FY2023.

The operating result of Asset & Wealth Management increased significantly to € 1,176 million (+22.6%) thanks to the continued strong performance of Banca Generali and the growing Asset Management result, which benefitted from the consolidation of Conning Holdings Limited (CHL).

The operating result of the Holding and other businesses segment was € -536 million (€ -415 million FY2023) mainly due to lower intragroup dividends.

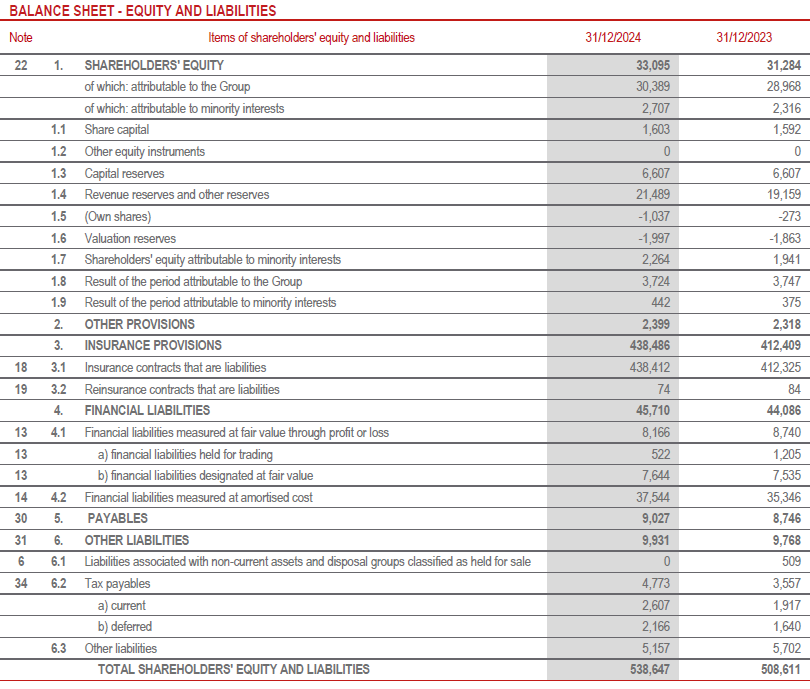

The adjusted net result1 rose to € 3,769 million (€ 3,575 million FY2023) – a record high – demonstrating the positive effect of the Group’s diversified profit sources. This result was achieved despite significantly lower net realised gains compared to FY2023. The net result amounted to € 3,724 million (€ 3,747 million FY2023) also due to the capital gains from disposals in 20232.

The Group’s shareholders' equity increased to € 30.4 billion (+4.9%), thanks to the net result for the period, partially offset by the 2023 dividend payment.

The Contractual Service Margin (CSM) stood at € 31.2 billion (€ 31.8 billion FY2023).

The Group’s Total Assets Under Management (AUM) grew significantly to € 863.0 billion (+31.6% compared to FY2023) mainly reflecting the inclusion of the AUM of CHL and positive net inflows.

The Group confirms its solid capital position, with the Solvency Ratio at 210% (220% FY2023) with the decline primarily reflecting the acquisition of Liberty Seguros and the € 500 million share buy-back programme completed in 2024.

Successful completion of the “Lifetime Partner 24: Driving Growth” plan

Thanks to the strong results achieved over the plan period concluding with an excellent FY2024 performance, Generali confirms that it has successfully delivered its 2022-2024 strategic plan, over-achieving all the ambitious targets:

- Strong earnings growth of 11.3% EPS CAGR vs 2021-24 target range 6-8%3

- Increased cumulative Net Holding Cash Flow: € 9.6 billion (2022-24) vs. target of more than € 8.5 billion4

- Higher dividend: € 5.5 billion of cumulative dividends (2022-24) vs. target of € 5.2-5.6 billion5. This was complemented by the € 1 billion total of share buybacks executed in the period 2022-2024.

Dividend per share

The dividend per share, which will be proposed at the upcoming Annual General Meeting, is € 1.43 payable as from 21 May 2025, while shares will trade ex-dividend as from 19 May 2025.

This represents a 11.7% increase compared to the prior year, reflecting the Group’s excellent results, the strong cash and capital position and the increasing focus on shareholder returns.

The dividend proposal represents a total maximum pay-out of € 2,172 million.

Life

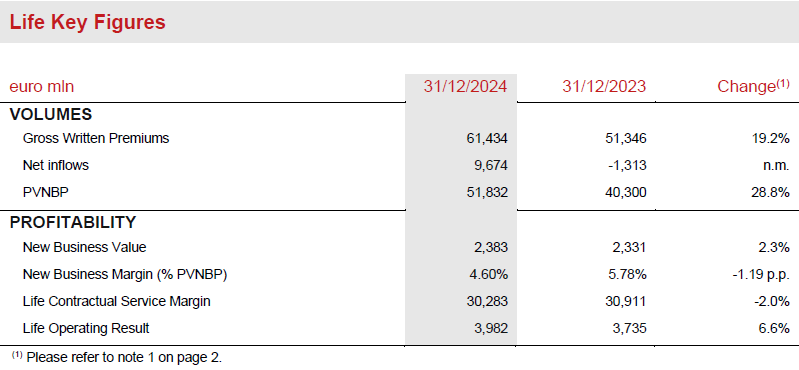

- Operating result rose to € 3,982 million (+6.6%)

- New Business Margin was 4.60% (-1.19 p.p.)

- New Business Value (NBV) grew to € 2,383 million (+2.3%)

Gross written premiums in Life6 grew significantly to € 61.4 billion (+19.2%) driven by strong performances across all business lines. Protection continued its healthy growth trajectory (+9.7%) in all main countries. Savings improved substantially (+23.3%), mostly thanks to the performance in Italy, France and Asia. Unit-linked recorded strong growth (+23.2%), led by Italy, France and Germany.

Life Net inflows returned to robust positive net collection in 2024 reaching € 9.7 billion. The protection and unit-linked lines recorded positive net inflows, with protection inflows growing to € 5.2 billion, led by Italy, France and Asia, while unit-linked net inflows rose to € 5.8 billion, also mainly driven by Italy and France. Net outflows from savings and pension (€ -1.3 billion) improved significantly (€ -10.2 billion FY2023) also benefitting from the commercial actions implemented since 2023 and the normalisation of lapse rates.

New business volumes (expressed in terms of present value of new business premiums or PVNBP) increased significantly to € 51.8 billion (+28.8%), thanks to:

- strong production of savings in Italy reflecting the effectiveness of the commercial strategy

- France, benefitting from market momentum in hybrid products

- China, which recorded exceptional volumes in the first half of the year

- protection business growth, amplified by the IFRS 17 accounting treatment of collective protection business in France7. After neutralising for this accounting effect, without real economic implications, PVNBP would have increased by 23.2%.

New Business Value (NBV) rose to € 2,383 million (+2.3%) supported by strong volumes. The New Business Margin (NBM) stood at 4.60% (-1.19 p.p.). After neutralising the accounting effect of French protection business, the NBM reduction would have been limited to about -0.9 p.p., mainly reflecting commercial initiatives in Italy (-0.5 p.p.), the effect of lower interest rates (-0.3 p.p.) and other minor effects spread across the Group.

The Life Contractual Service Margin (Life CSM) was € 30.3 billion (€ 30.9 billion FY2023). The Life New Business CSM of € 2,827 million, coupled with the expected return of € 1,757 million, more than offset the Life CSM release of € 2,986 million. The latter also represented the main driver (approximately 75%) of the operating result, which increased to € 3,982 million (€ 3,735 million FY2023). The Life Operating Investment Result was € 943 million (€ 833 million FY2023).

During 2024, the Group continued to implement strong underwriting discipline across its Life portfolio, with the share of reserves without guarantees increasing from 38.3% in FY2023 to 41.4% in FY2024. The average guarantee in force declined to 1.17%. The share of capital-light reserves grew by 2.4 percentage points to 71.8%. This ongoing improvement in the quality of the in-force book provides strong foundations for the “Lifetime Partner 27: Driving Excellence” plan.

P&C

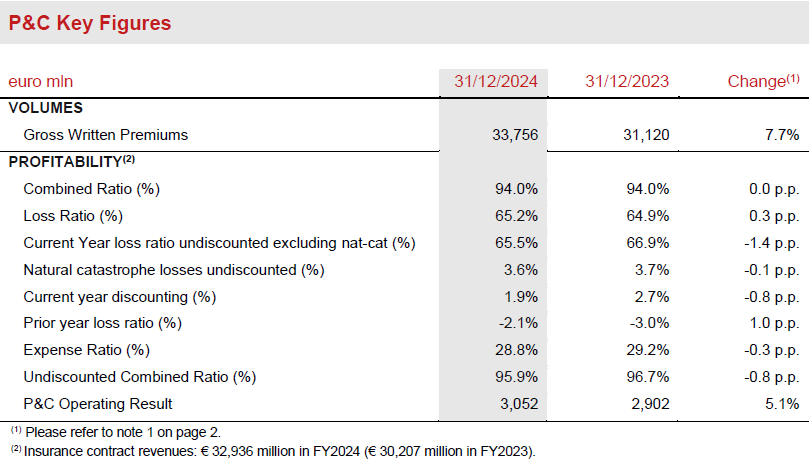

- Premiums increased to € 33.8 billion (+7.7%)

- Combined Ratio stood at 94.0% (0.0 p.p.). Undiscounted Combined Ratio improved to 95.9% (-0.8 p.p.)

- Operating result increased to € 3,052 million (+5.1%)

P&C gross written premiums grew to € 33.8 billion (+7.7%) thanks to the performance of both business lines. Non-motor was up 6.6%, achieving growth across all main areas in which the Group operates. The motor line rose significantly by 10.5%, across all the main areas and specifically thanks to the positive performance seen in CEE, Germany, Italy and Argentina. Excluding the contribution from Argentina, a country impacted by hyperinflation, motor line premiums increased by 6.6%.

The Combined Ratio stood at 94.0% (unchanged compared to FY2023) despite a lower current year discounting benefit (+0.8 p.p.) reflecting the decline in interest rates and a lower prior year development (2.1 p.p. compared to 3.0 p.p. in FY2023). The undiscounted combined ratio improved to 95.9% (96.7% FY2023). The undiscounted current year loss ratio (excluding nat-cat) improved to 65.5% (66.9% FY2023). The expense ratio improved to 28.8% (29.2% FY2023). When looking at the underlying business trends, excluding the impact of discounting and prior year development, the Group was able to achieve a 1.7 p.p. improvement in the undiscounted current year attritional combined ratio in FY2024 compared to FY2023, one of the best performances in the industry. This improvement reflects the pricing and technical actions implemented since 2023 and provides a boost to the Group in returning to P&C technical excellence after the post-COVID inflationary shock.

The operating result increased to € 3,052 million (€ 2,902 million FY2023), reflecting the above and despite € 1,202 million of nat-cat losses (€ 1,127 million FY2023). The operating insurance service result was € 1,976 million (€ 1,807 million FY2023) thanks to the growth of the P&C business and the improved current year attritional profitability, more than compensating a lower discounting benefit.

The operating investment result was € 1,076 million (€ 1,095 million FY2023) reflecting a € 320 million increase in the operating investment income to € 1,710 million. This was more than compensated by a € 340 million increase in the insurance finance expenses to € 634 million.

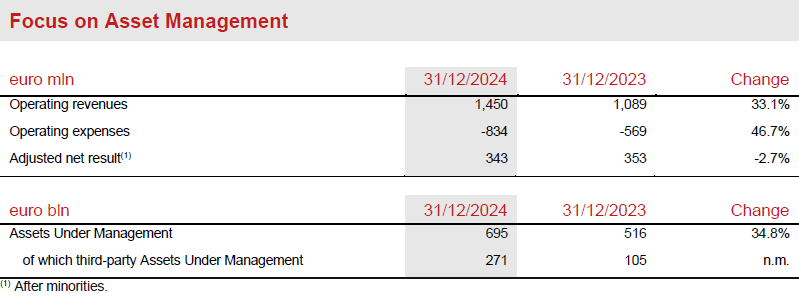

Asset & Wealth Management

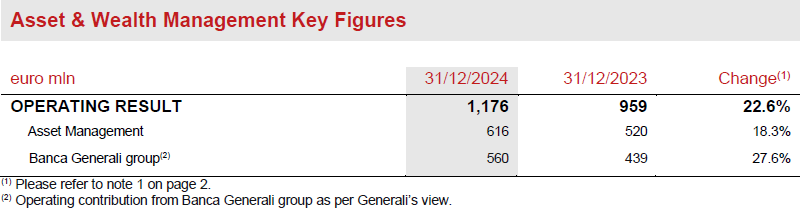

- Asset & Wealth Management operating result grew to € 1,176 million (+22.6%)

- Banca Generali group operating result increased strongly to € 560 million (+27.6%)

The Asset & Wealth Management operating result grew significantly to € 1,176 million (+22.6%). The Asset Management operating result increased to € 616 million (+18.3%) reflecting the consolidation of CHL. The operating result of the Banca Generali group rose substantially to € 560 million (+27.6%), thanks to the improvement in the net interest margin coupled with the continued diversification of fee income sources and a significant contribution from performance fees. Total net inflows at Banca Generali for FY2024 were € 6.6 billion.

The Asset Management operating result increased to € 616 million (+18.3%), reflecting the € 70 million contribution from CHL, without which the operating result would have grown +4.8% year-on-year.

Operating revenues recorded positive growth (+33.1%, or +7.7% excluding CHL), reflecting the contribution of CHL (€ 278 million, including a strong level of performance fees of € 29 million). Excluding the contribution from CHL, operating revenues benefitted from higher recurring fees, performance fees and non-recurring fees from real estate and infrastructure investments.

Operating expenses rose to € 834 million (+46.7%, or +10.3% excluding CHL), reflecting the consolidation of CHL equivalent to € 207 million. The increase excluding CHL was primarily driven by higher compensation costs. The Cost/Income ratio of Asset Management was 57.5% (or 53.5% excluding CHL).

The adjusted net result of the Asset Management segment was € 343 million (-2.7%). The net result was also affected by one-off transaction and integration costs related to the acquisition of CHL, expenses from other extraordinary projects and the dilution effect related to the 16.75% stake held by Cathay Life in Generali Investments Holding.

AUM pertaining to the Asset Management companies rose to € 695 billion at YE2024 (+34.8% compared to YE2023), mainly thanks to the CHL acquisition.

Third-party AUM managed by the Asset Management companies stood at € 271 billion, including € 164 billion for CHL.

Third-party net flows were € +1.8 billion, thanks to positive net flows in 4Q2024 of € +3.8 billion.

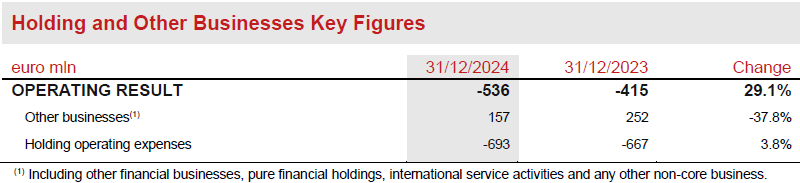

Holding and other business

- Operating result stood at € -536 million

The operating result of the Holding and other businesses segment was € -536 million (€ -415 million FY2023).

The operating result of Other businesses amounted to € 157 million (€ 252 million FY2023), impacted by lower intragroup dividends. Operating expenses grew by 3.8% mainly reflecting the higher cost of share-based payments and higher development costs related to internal projects.

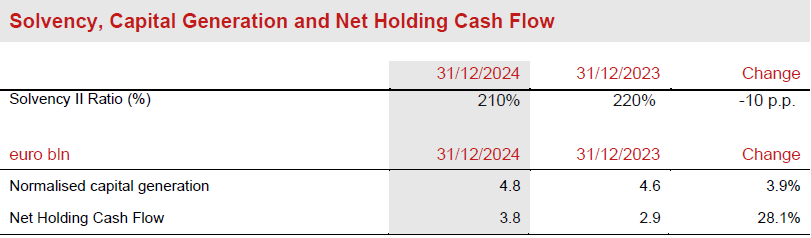

Solvency, Capital Generation and Net Holding Cash Flow

- Solid capital position with the Solvency Ratio at 210% (220% FY2023)

- Continued strong Normalised Group Capital Generation rising to € 4.8 billion

- Sustained increase in Net Holding Cash Flow landing at € 3.8 billion underpinned by remittance growth

The Group confirms its solid capital position with a Solvency Ratio at 210% (220% FY2023). The robust contribution of capital generation (+21 p.p.) was more than offset by the effect of M&A operations completed during 2024 (-8 p.p., primarily driven by the acquisition of Liberty Seguros), economic variances (-9 p.p., mainly due to the widening of non-domestic government bond spreads and declining interest rates, partially mitigated by positive equity market performance), non-economic variances (-1 p.p. mostly due to the trend in lapses in Italy and France and the update to related assumptions partly compensated by derivative positions and derisking activities on the equity market), regulatory changes (-4 p.p., largely attributable to the changes introduced by EIOPA at the beginning of the year and the ineligibility of subordinated debt transferred from Genertel to Assicurazioni Generali) and capital movements (-9 p.p., stemming from the impact of the dividend for the period and the share buyback programme, net of the subordinated debt issuance completed in the last quarter). The impact from the € 500 million share buyback announced at the Investor Day in January 2025 will be accounted for on the Solvency Ratio after having received all the regulatory approvals.

The Normalised Group Capital Generation increased to € 4.8 billion (€ 4.6 billion FY2023), supported by the positive contribution of both Life and P&C, and reflecting also the share buyback for the purposes of the Long-Term Incentive Plan (LTIP) as well as the Group’s incentive and remuneration plans under execution, which were previously reported as non-economic variance.

The Net Holding Cash Flow rose to € 3.8 billion (€ 2.9 billion FY2023), mainly thanks to growing remittance driven by the positive contribution from Capital Management actions and steady growth of the recurring component.

Outlook

The global economy is expected to grow at around 3% in 2025, similar to 2024, thanks to resilient labour markets and the services sector. The US hit a speed bump in the first quarter but is still expected to continue to outperform other advanced economies. Meanwhile, the Euro area may be impacted by trade uncertainties but is expected to see a modest improvement in the second half of the year. Growing tensions in the transatlantic alliance imply a relaxation of EU fiscal constraints to fund defence spending. Disinflation is progressing at a slow pace globally, as wage growth normalises. US tariffs and ensuing retaliation could further slow this progress. After moving largely in tandem on rate cuts in 2024, the paths of the Fed and the ECB have started to diverge, with the Fed possibly holding off until mid-year while the ECB has proceeded with a sixth rate cut at the beginning of March.

With the new Lifetime Partner 27: Driving Excellence strategic plan, which focuses on excellence in customer relationships, excellence in core capabilities and excellence in the Group operating model, the Group will accelerate profitable growth in Life by capitalising on its broad customer base and strong distribution footprint. In addition, the Group will improve technical proficiency to increase profitability and enhance effectiveness by scaling Group-wide assets across the value chain. Focus will remain on simplification and innovation, offering updated and integrated solutions to adapt to evolving customer needs throughout their lifetime.

In Life, primary focus areas include protection and health, as well as capital-light savings with the aim to create a wide range of insurance solutions adapted to different risk and investment profiles for the benefit of both the policyholder and the Group. For protection and health products, the Group aims to offer integrated end-to-end services and will also further upgrade customer experience and distribution. Hybrid and unit-linked offerings will continue to be a priority to address growing customer needs for financial security with the objective of becoming the go-to partner for retirement and savings.

In P&C, Generali's objective is to maximise profitable growth with a focus on the non-motor line, strengthening its position and offering especially in countries with high growth potential. The Group confirms and strengthens its adaptive approach towards tariff adjustments, also considering rising reinsurance coverage costs due to the increased natural catastrophe claims in recent years. The non-motor offer will continue to be enhanced with additional modular solutions designed to meet specific customer needs, providing improved and innovative prevention, assistance and protection services, enabled by the latest digital tools.

With reference to the Group’s investment policy, it will continue to pursue an asset allocation strategy aimed at ensuring consistency with liabilities to policyholders and, where appropriate, at increasing current returns. Investments in private and real assets continue to be an important part of the Group’s strategy, following a prudent approach that considers the lower liquidity of these instruments. In the real estate sector, the Group is pursuing both geographical and sector diversification, closely monitoring and evaluating market opportunities as well as asset quality.

In Asset & Wealth Management, Asset Management will continue to expand the product offering, particularly in real assets and private assets, enhance distribution capabilities, and extend its presence in new markets, further supported by the acquisition of Conning Holdings Limited, completed in 2024. In Wealth Management, the Banca Generali group will continue to focus on its targets of size, profitability and high shareholder remuneration.

After successfully over-delivering against the financial targets of its Lifetime Partner 24: Driving Growth plan, the Group is committed to delivering – through the new Lifetime Partner 27: Driving Excellence plan – new ambitious 2025-2027 growth targets:

- strong earnings growth: 8-10% EPS CAGR8

- solid cash generation: > €11 billion Cumulative Net Holding Cash Flow9

- increasing dividend10 per share: > 10% DPS CAGR with ratchet policy

With a clear capital management framework with increased focus on shareholder returns:

- more than € 7 billion in cumulative dividends11 (2025-27)

- committed to at least €1.5 billion share buyback12 over the plan horizon

- € 500 million buyback to be launched in 202513

Generali's Sustainability Commitment

Sustainability was fully embedded in Generali’s Lifetime Partner 24: Driving Growth strategy and positively contributed to its delivery. The main achievements for 2024 include:

- as a responsible investor, € 13.9 billion (+€4.8 billion vs FY2023) in new green and sustainable investments (2021-2024);

- as a responsible insurer, € 25.2 billion (+€4.4 billion vs FY202314) in premiums from insurance solutions with ESG components;

- as a responsible employer, 84% of employees upskilled (+16 p.p. vs. FY2023), 38.6% of strategic positions held by women (+3.8 p.p. vs. FY2023) and a -46.1% (-8.5 p.p. vs. FY202315) emissions reduction from our own operations against the base year 2019;

- as a responsible corporate citizen, through the global initiatives of The Human Safety Net, extended initiatives to 26 countries with 85 NGO partners;

- the successful placement of the sixth and seventh green bonds, for € 500 million and € 750 million respectively.

Sustainability is deeply rooted in the Lifetime Partner 27: Driving Excellence strategy with clear commitments to support a green and just transition and foster societal resilience.

Other Board Resolutions

The Board of Directors also approved:

- a share allocation of nr. 391,229 treasury shares to implement the ‘Group Long Term Incentive Plan (LTIP) 2020-2022’, having ascertained the occurrence of the conditions on which it was based.

- a share allocation of nr. 7,028,164 treasury shares to implement the ‘Group Long Term Incentive Plan (LTIP) 2022-2024’, having ascertained the occurrence of the conditions on which it was based.

- the cancellation, without reducing the share capital, equal to 19,635, 081 own shares, acquired for that end, implementing the resolutions by the Annual General Meeting of 24 April 2024. The execution of the resolution of the Board is subject to the authorisation of the related amendments to the articles of association by IVASS.

Significant events after 31 December 2024

On January 17th, Generali Investments Holding and MGG Investment Group announced the signing of a definitive agreement under which Generali Investments Holding’s wholly-owned subsidiary, Conning & Company, will acquire a majority stake in MGG and its affiliates.

On January 21st, Generali and BPCE announced the signing of a non-binding Memorandum of Understanding to create a joint venture between their respective asset management operations, Generali Investments Holding and Natixis Investment Managers. The proposed new entity envisages the creation of the largest asset manager in Europe by revenues, ranking #9 worldwide by AUM with critical scale in the fast-evolving asset management market.

On January 30th, Generali presented to the investment community its new three-year strategic plan, Lifetime Partner 27: Driving Excellence.

***

The Annual Integrated Report and Consolidated Financial Statements 2024, as well as the Management Report and Parent Company Financial Statements 2024 will be published on the Group website on 24 March 2025.

Q&A conference call

The Group CEO, Philippe Donnet, the Group CFO, Cristiano Borean, the Group General Manager, Marco Sesana and CEO Insurance, Giulio Terzariol, will host the Q&A session conference call for the consolidated results of the Generali Group as of 31 December 2024, which will be held on 13 March 2024, at 12.00 pm CEST. To follow the conference call, in a listen only mode, please dial +39 02 8020927.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

Generali 4Q2024 results

Further information by segment

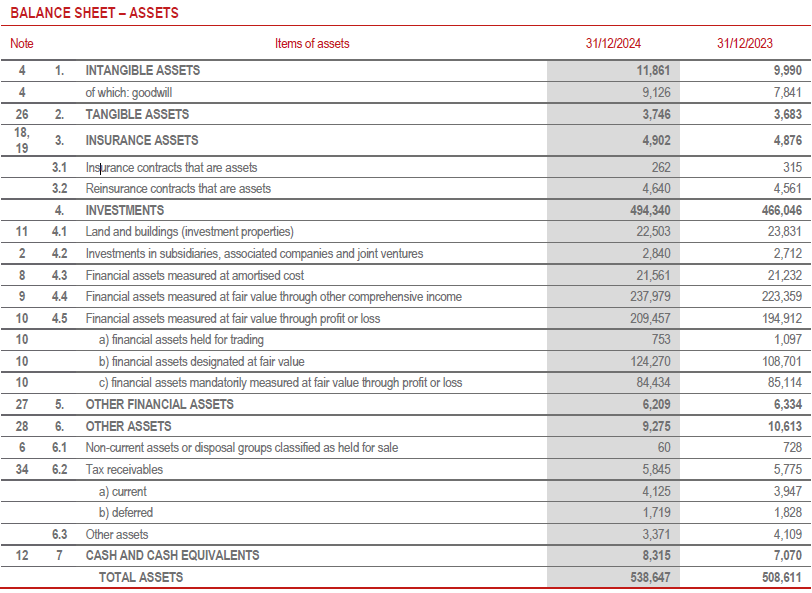

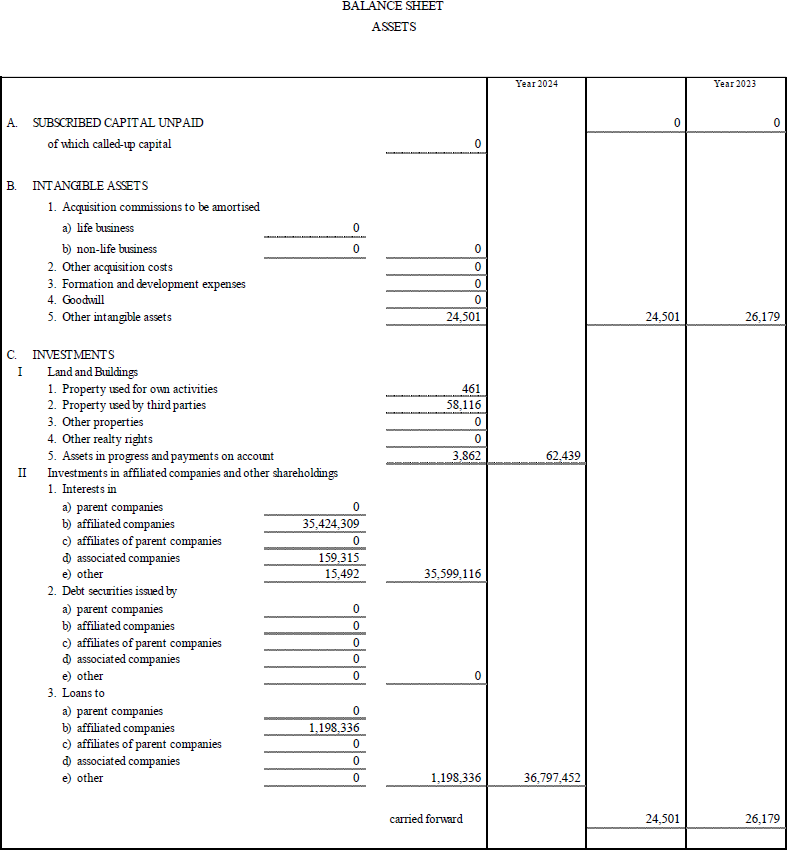

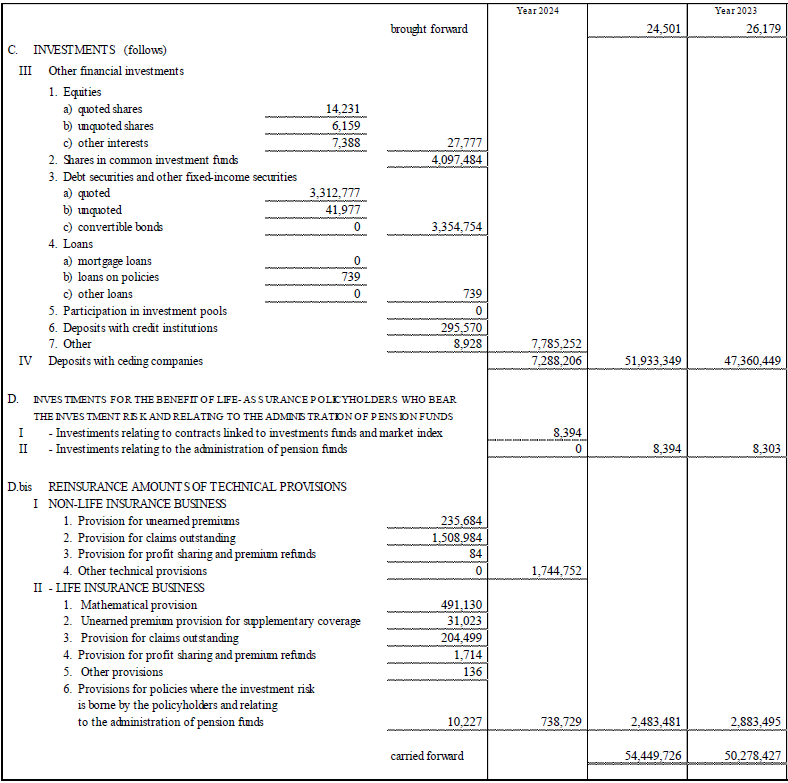

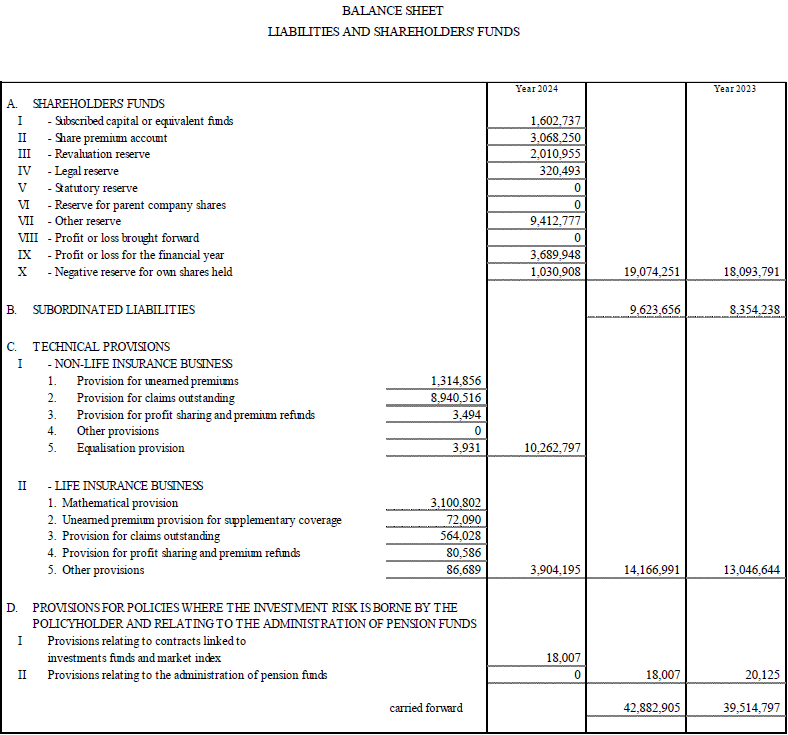

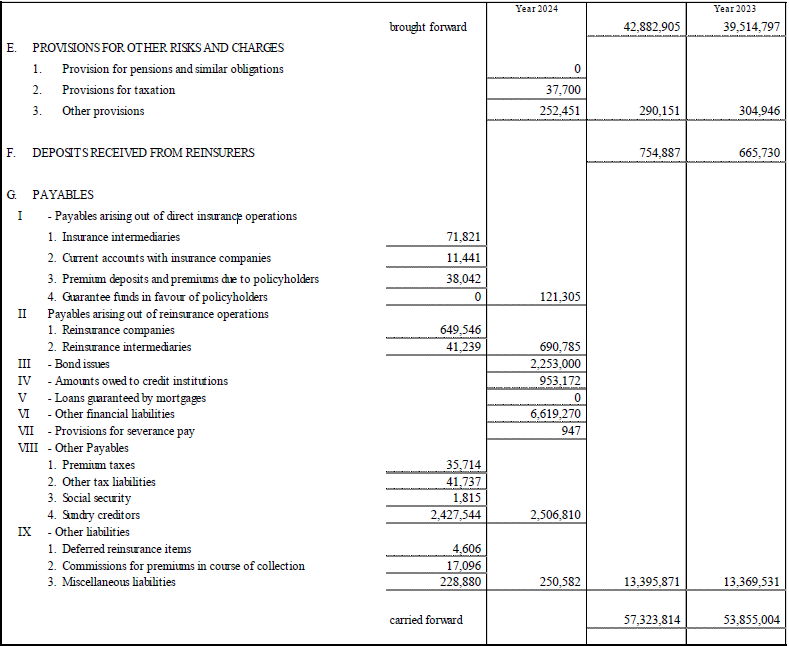

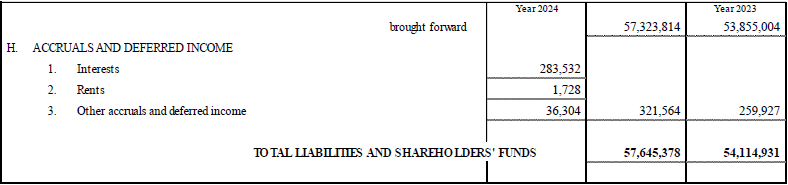

Balance sheet (16)

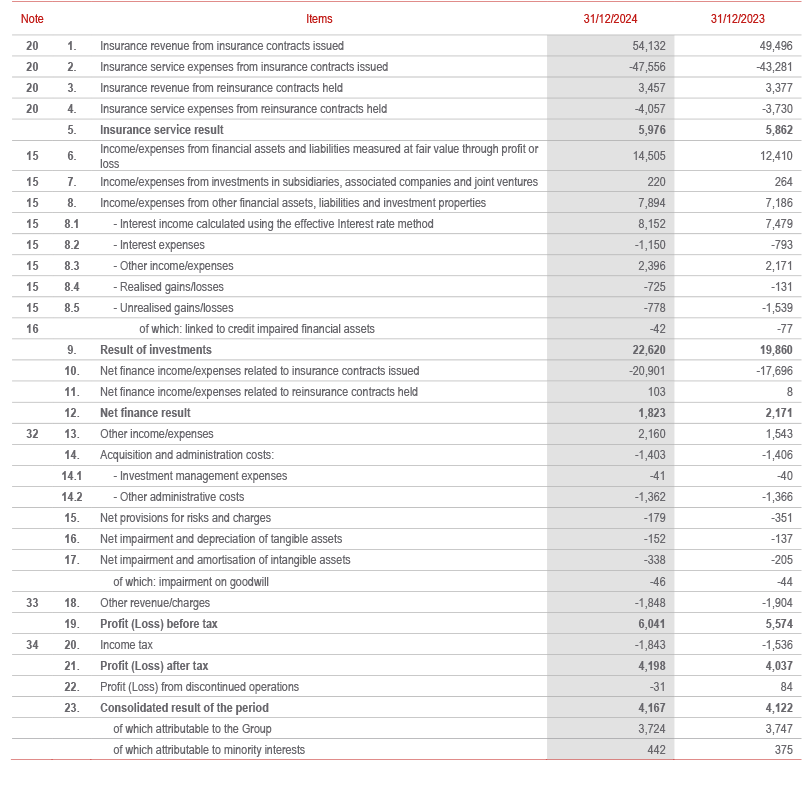

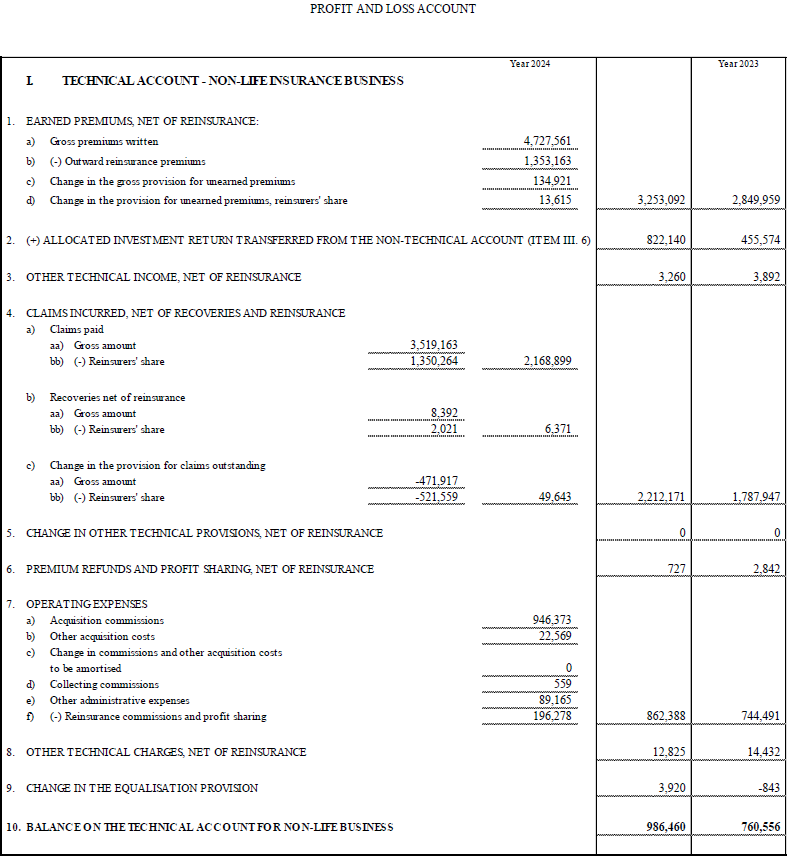

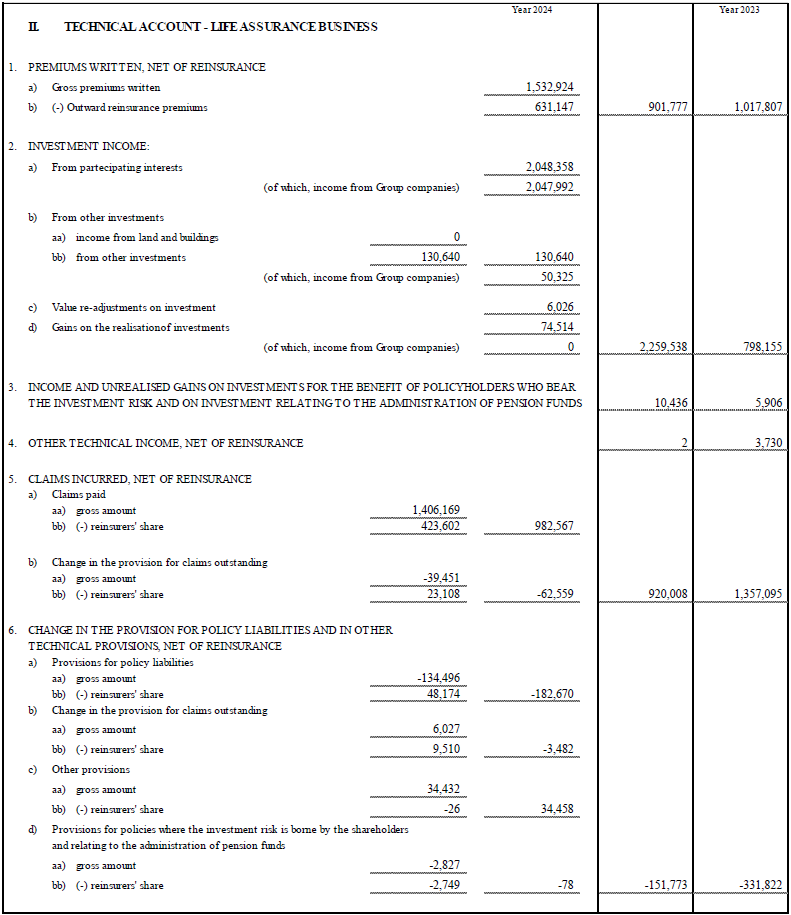

Income statement

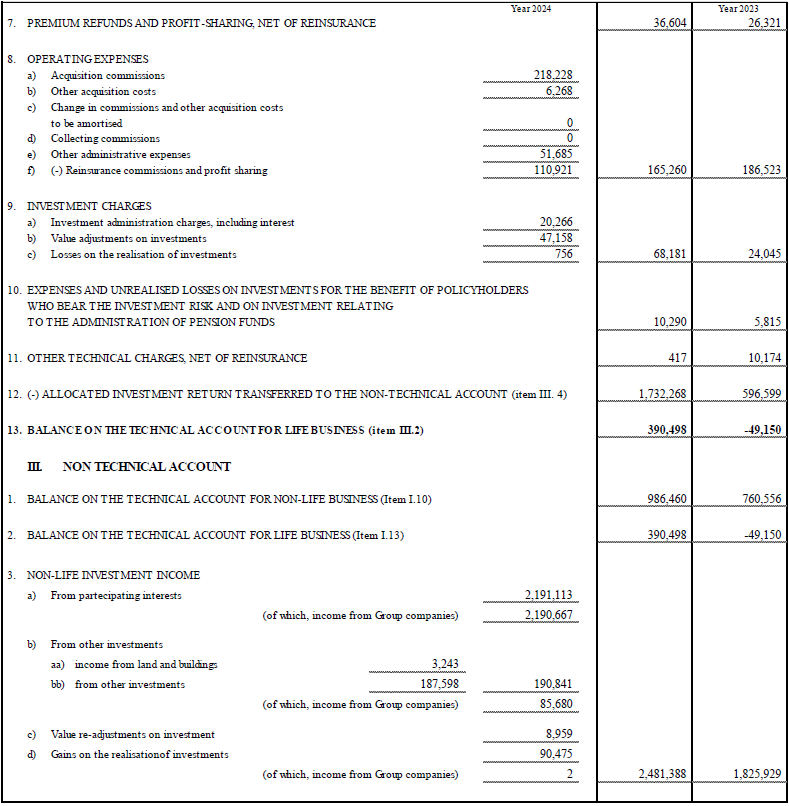

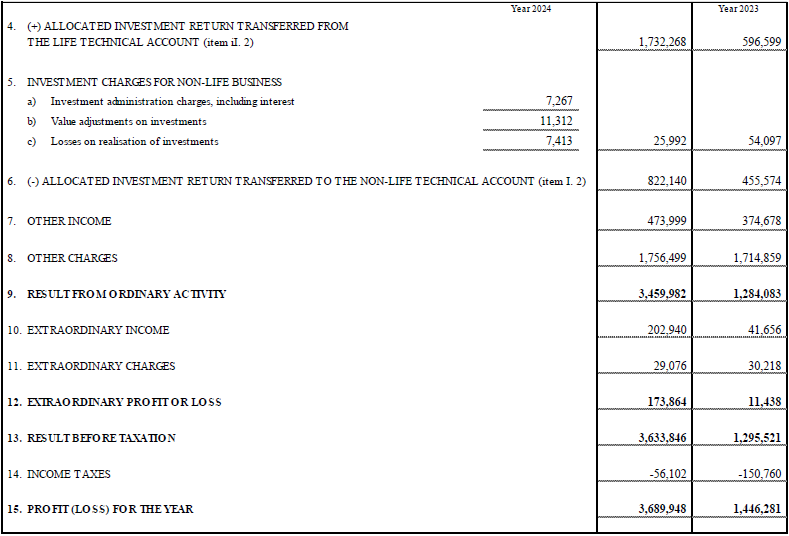

Parent Company’s Balance Sheet and Income Statement (17)

(in thousands euro)

Profit and Loss Account

(in thousands euro)

1 For definition of the adjusted net result, please refer to note 2 on page 2.

2 Refers to capital gains from disposals during 2023, in particular the sale of Generali Deutschland Pensionskasse and the Cattolica JV.

3 3 year CAGR.

4 Expressed on a cash basis (i.e. cash flows are reported under the year of payment).

5 Expressed on a cash basis.

6 Including premiums from investment contracts equal to € 1,566 million (€ 1,383 million FY2023).

7 French collective protection business underwritten in 4Q 2023 with coverage starting in 2024 was deemed to be profitable and hence in line with IFRS 17 requirements, recognised entirely in 1Q 2024. The majority of the business underwritten in 4Q 2022 with coverage starting in 2023 was considered onerous and thus recognised earlier in 4Q 2022.

8 3-year CAGR based on the Group’s Adjusted Net Result.

9 Expressed on a cash basis.

10 Subject to all relevant approvals.

11 Subject to all relevant approvals.

12 Subject to all relevant approvals.

13 Subject to all relevant approvals.

14 Figures subject to approximation and aimed at illustrating the year-over-year growth.

15 GHG emissions include 100% of the Group’s workforce linked to emission sources in operational control (88.4% measured, +2.6 p.p. vs. FY2023, and 11.6% extrapolated). The growth of the reporting perimeter made it necessary to restate the entire trend from 2019.

16 With regard to the financial statements envisaged by law, note that the statutory audit on the data has not been completed. The Group will publish the final version of the Consolidated Full-Year Financial Report 2024 in accordance with prevailing law, also including the Independent Auditor’s Report. In compliance with IFRS8, it should be noted that, following the changes introduced by the application of the new IFRS9 and IFRS17, comparative data in the financial statements have been appropriately restated.

17 With regard to the financial statements envisaged by law, note that the statutory audit on the data has not been completed. The Group will publish the final version of the Proposal of Management Report and Financial Statements of Parent Company 2024 in accordance with prevailing law. In compliance with IFRS8, it should be noted that, following the changes introduced by the application of the new IFRS9 and IFRS17, comparative data in the financial statements have been appropriately restated.