Generali's GenAI Revolution: Transforming Business Landscapes with Conversational Generative Artificial Intelligence

From job evolution to customer personalization: unveiling the multi-faceted impact of Conversational Generative Artificial Intelligence across industries, featuring Generali's innovation with “Chatty”, the new chatbot in four languages

The conversational generative artificial intelligence tool ChatGPT has undeniably made a significant impact globally. Within just a few months of its release, it quickly earned the title of the fastest-growing app in history. But what makes the technology behind it so groundbreaking?

What is Conversational Generative AI?

Conversational AI is a technological advancement that facilitates machines in engaging with humans in a way that mimics natural human conversation; in other words, it produces human-like speech. It can be seen as being more closely aligned with human thinking and understanding, which consequently alter the way in which it responds.

Generative AI (or GenAI) utilizes machine learning algorithms and datasets for training to produce new outputs for the user, such as images, texts, and sounds.

The two technologies together make up applications such as ChatGPT.

Reshaping the job market with AI tools

It is becoming more common for companies to implement Generative AI solutions to enhance their business. While the result of such improving technology and the integration of conversational generative AI tools may lead to the redundancy of certain job functions, at the same time it also creates new ones.

Tools like ChatGPT have the potential to change the way people work by taking on the role of “thought partners”. Most importantly, it empowers individuals to “work smarter” by enhancing their current skills and capabilities through the assistance of highly advanced artificial intelligence.

Several companies are leveraging this technology to innovate and develop new services for their customers, while others are adopting it to streamline and optimize their internal operations.

GenAI and insurance

Insurers are already using GenAI to automate processes and integrate diverse datasets, as well as to analyse customer behaviour. In areas such as actuarial and underwriting, GenAI streamlines the ingestion of large datasets, freeing underwriters to focus on high-value analytical and risk assessment work.

However, the most significant impact is expected in customer-facing operations. Improved analysis of market trends and customer sentiment will empower insurers to personalize and eventually individualize customer experiences. Virtual sales and service agents will be able to handle complex issues, offer tailored advice, and provide a personal touch in digital channels.

“Chatty”, how Generali is transforming customer service

Generali is also strategically committed to innovation in the industry. One of the latest examples of this is “Chatty”, the new AI-based chatbot, launched by Generali Switzerland, and developed together with the start-up Enterprise Bot and HITS - House of Insurtech Switzerland, first CorpUp studio where a Corporate (Generali) co-creates innovative solutions with a startup.

Thanks to generative AI and process automation, "Chatty" provides customer support in selecting insurance policies, answers questions, and assists in case of claims. Its operation is made possible by integrating DocBrain and ChatGPT technologies.

Generali Switzerland began using the chatbot on its German website in autumn 2023, and it has also been available in French, Italian, and English since the beginning of 2024.

"Chatty" was also honoured during the ITC DIA Europe 2023 Conference in Monaco with the ITC DIAmond Award for offering a customer-centric solution based on the use of AI and automation.

Leading innovation, a pillar of Generali’s strategy

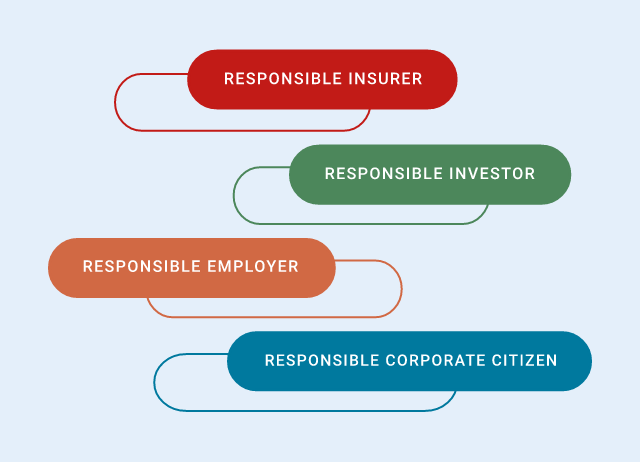

Leading innovation is one of the pillars of the “Lifetime Partner 24: Driving Growth” strategic plan and investment in digital technology leveraging the potential of data will total € 1.1 billion over the course of the plan. As a customer-focused and data-driven innovator, our goal is to enhance customer value through the “Lifetime Partner” advisory model. This involves expanding our digital advisory capabilities and implementing a seamless approach across all distribution channels.